Overview

In 2017, a Chinese national security law mandated citizens and business entities comply with requests for information by Chinese intelligence agencies. With this law, the presence of Chinese telecommunications companies in South America poses potential security threats.

As of 2022, multiple Chinese telecommunications companies had established a presence in South America. Since then, these companies have spread further throughout the region, proliferating 5G technology. As Chinese prominence in the region grows and 5G technology becomes more integrated into people's lives, concerns over data autonomy, corporate espionage, and communications grid vulnerabilities will become more central in the debate over how 5G development should progress.

Activity

A recent Chinese national security law presents potential security implications for the expanding presence of Chinese telecommunications companies in South American 5G networks, specifically Brazil, Argentina, and Venezuela. The geolocated data throughout this study documenting China's telecommunications presence in South America helps one understand and manage risk.

5G cellular networks represent a major leap forward in telecommunications technology, offering increased internet connection speed and facilitating the implementation of new technologies, including autonomous vehicles, augmented reality, and the Internet of Things. However, as 5G technologies become more widespread and deeply integrated--personal, corporate, and governmental information becomes more accessible and susceptible to hacking or cyberattacks. Moreover, a deeply interconnected 5G system may prove difficult to isolate and fully protect. As such, the realm of telecommunications provides a new avenue through which countries can gather intelligence and grow their global influence. Given the structure of its national security laws, China has the potential to take advantage of this new opportunity.

METHODOLOGY

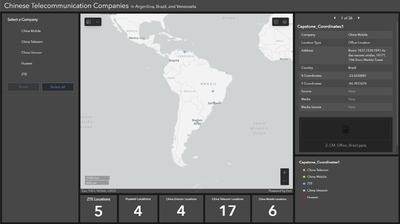

This study utilizes open reporting and commercial satellite imagery to examine the extent and potential impacts of Chinese telecommunications expansion and 5G infrastructure deployments in South America using Brazil, Argentina, and Venezuela as the cross-section samples. Geospatial analysis is supplemented with an extensive review of press, corporate, and government documentation. Initial data on the presence of Chinese telecommunications companies in the region as of mid-2022 was provided by researchers at James Madison University and is accessible at this ArcGIS Dashboard, pictured below in Figure 1. At the end of this article, we provide a downloadable Excel sheet of this data and KML and Shapefiles displaying those locations which are mappable at a high level of precision.

Recognizing 5G infrastructure in satellite imagery is difficult since cell towers leave a small aerial footprint and 5G infrastructure is often nearly identical, if not fully identical, to 4G infrastructure. 5G infrastructure consists of small-cell and macrocell base stations, which are essential for providing high-quality service to urban and rural areas, respectively. These physical pieces of infrastructure form a 5G network. However, not all 5G infrastructure is dedicated to 5G alone; it is frequently an extension of existing 4G infrastructure with hardware and/or software augmentations. This situation, where 5G service depends on a 4G core of infrastructure, is known as Non-Standalone Architecture and complicates the ability to visually differentiate between 4G and 5G infrastructure.

CHINESE NATIONAL SECURITY LAW

The Chinese government’s relationship with domestically-owned telecommunications companies makes their global expansion a unique security threat. China’s 2017 national security law mandates that domestic entities cooperate with the government when requested.

- Article 7 states: “Any organization or citizen shall support, assist and cooperate with the state intelligence work in accordance with the law, and keep the secrets of the national intelligence work known to the public. The State protects individuals and organizations that support, assist and cooperate with national intelligence work. ”

- Simply, this article casts the broad brush that national security cooperation is everyone's business as a citizen of China.

- Article 10 states: "The state intelligence work agencies shall use the necessary methods, means and channels to carry out intelligence work at home and abroad according to their work needs.

- Simply, this article can compel Chinese overseas businesses to hand over data for broad national security purposes.

- Article 11 states: “The state intelligence work institutions shall collect and handle the acts or acts of foreign institutions, organizations and individuals that are implemented or instructed or funded by others, or colluded by domestic and foreign institutions, organizations and individuals to endanger the national security and interests of the People's Republic of China. Relevant information provides information or reference for preventing, stopping and punishing the above actions.”

- Simply, this article allows Chinese intelligence agencies to process information on foreign actors that they deem to be jeopardizing national security interests.

- Article 14 states: "The state intelligence work organization shall carry out intelligence work according to law, and may require relevant organs, organizations and citizens to provide necessary support, assistance and cooperation.”

- Simply, this article empowers intelligence agencies to compel civilians to collaborate with them.

The 2017 Chinese National Security Law outlined above requires those under Chinese jurisdiction to renounce all information that may be relevant to national security. In essence, Chinese intelligence agencies are empowered to compel Chinese individuals and companies to assist them in collecting intelligence on other countries. This ability to requisition company data is uniquely useful when applied to telecommunications companies that operate abroad, since telecom companies process huge amounts of information, some of which is inevitably sensitive. Any company or individual data that is held on a device linked to a Chinese telecommunications company could potentially be exploited for Chinese intelligence interests. This leaves 5G users in regions with Chinese 5G networks vulnerable to Chinese cyber threats and intelligence collection.

U.S. CONCERNS

Concerned about the implications of the 2017 Chinese National Security Law, in the Fall of 2021 the United States officially banned Huawei, ZTE, and some other Chinese telecommunications companies from receiving new equipment licenses from American regulators. US concerns can serve as a useful risk framework for other regions such as South America.

CHINESE TELECOMMUNICATIONS IN SOUTH AMERICA

Globally, Chinese companies are leading the charge in developing and implementing 5G technology. This market dominance is in part due to the direct support that Chinese domestic telecommunications companies have been receiving from the government since 1996. For example, Huawei, the world’s largest telecom company, has become a major player in the race for 5G both within the Chinese domestic market and on the world stage. Huawei has received $75 billion in support from the Chinese government since its founding, helping it to support a research and development budget comparable to that of Amazon, Inc. Using this governmental support, Huawei and other Chinese companies have developed expertise in 5G technology. In addition to developing highly functional products, this financial backing has enabled Chinese corporations to sell their products at artificially low prices, sometimes even below the cost of production. As a result, countries around the world have courted the business of Chinese telecom companies for their low prices and advanced technology to include South American markets.

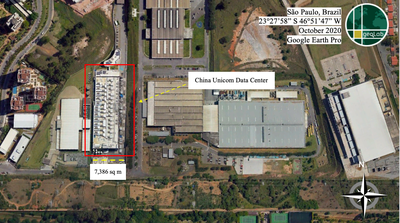

Since the rise of 5G technology, Chinese telecommunications companies like Huawei and ZTE have moved into South America to expand their market presence. As more Chinese companies penetrate the South American market and gain greater market share, they gain access to an increasing amount of user data. In Venezuela, Brazil, and Argentina, a number of Chinese telecommunications companies have established a presence in densely populated areas. ZTE currently has five offices across the three countries, and Huawei has established nine offices in eight Latin American countries. A data center owned by China Unicom Global is pictured below in Figure 2 for context and characterization.

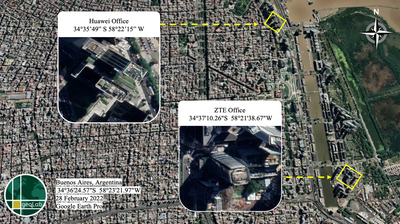

As of 2022, Huawei, ZTE, China Unicom, China Telecom, and China Mobile had established at least 36 facilities, including offices, data centers, and other points of presence across these three South American countries. The locations of these facilities are pictured below in Figure 3.

VENEZUELA

In Venezuela, the increasingly autocratic Maduro government has embraced the internet as a weapon of social control, progressively monitoring and restricting access since 2018. ZTE and Huawei have established particularly close relationships with the Maduro administration. In a nominal effort to strengthen national security, the government paid ZTE $70 million to build a database that collected civilian information including medical records and voter history. During a May 2019 speech, Maduro announced that the 5G rollout in Venezuela would be spearheaded by Huawei, and also denounced U.S. restrictions against the company. Maduro remains in power and has continued to strengthen relations between Venezuela and Chinese telecommunications companies. In 2021, he welcomed further collaboration with ZTE on 5G development. Figure 4 below displays a sample of ZTE's corporate presence in the country.

Huawei has also been an integral part of Venezuela’s telecommunications modernization projects from 2006 to 2019, bolstered by Chinese “oil for loan/goods” agreements. As a result, Huawei technologies are integrated across the Venezuelan telecommunications network. Movistar, a prominent Venezuelan cellular provider, leases its LTE capacity from Huawei, an arrangement that has been in place as early as 2014. (LTE stands for "long-term evolution" which is a standard for wireless broadband communication for mobile devices and data terminals). Reuters reported in 2018 that the widespread failure of Venezuela’s CANTV – the country's state-run telephone and internet service provider – to reliably cover much of the country has also increased reliance on Huawei local internet uplinks in many suburban and rural areas. Huawei has also been involved in an ongoing partnership with CANTV to upgrade its aging telecommunications infrastructure by providing equipment since at least 2006.

BRAZIL

Brazil has had a less consistent relationship with Chinese telecom companies due to former President Jair Bolsonaro's opposition to Huawei’s involvement in the country. Nonetheless, the company’s equipment is already used in most 3G and 4G networks provided by Brazilian telecommunication firms. Bolsonaro’s denunciation occurred around the time when the U.S. government was urging other countries to ban Huawei from 5G network expansion due to surveillance concerns. Nonetheless, Brazilian efforts are underway to implement 5G technology across the country, thus becoming more economically intertwined with China. Reuters reports that Brazil’s current President, Luiz Inácio Lula da Silva, is determined to build a relationship with China and Huawei to expand its 5G communications infrastructure. Already, the telecom giant controls 50% of the country’s telecommunications equipment market, and has a factory employing 2,000 people in São Paulo, with another $800 million facility on its way. Huawei has trained 600 professionals on telecommunications installation techniques. These new jobs and facilities build on the existing 40% of 4G network components installed before the 5G transition. In a recent 5G frequency band auction, numerous companies that use Huawei components and partnerships extensively were awarded contracts to operate 5G networks in Brazil. To date, 5G networks have opened and expanded ahead of schedule across several major metropolitan areas, including Brasília, João Pessoa and São Paulo. To supply new 5G infrastructure and devices to the region, Huawei also opened a new “smart factory” in São Paulo in 2022.

ZTE also has a strong presence in Brazil, which accounted for 9% of ZTE’s overseas revenue in 2011. That same year, ZTE agreed to invest in a high-tech industrial park in Hortolandia, São Paulo. This industrial park was slated to include the company’s first research and development facility in Latin America as well as a production plant, a training center, and a logistics center. The new facilities, estimated to cost $250 million, were expected to create 2,000 local jobs, though there is no recent textual or geospatial evidence confirming the implementation of this park. Despite the lack of evidence of the construction of this facility, ZTE has continued to expand its presence in Brazil through partnerships and technological development. ZTE has worked with various local manufacturers, including Vivo in 2016 and Qualcomm Technologies in 2019, to meet its infrastructure needs in Brazil. In 2023, Brazil’s National Telecommunications Agency (Anatel) approved ZTE’s new MC8020 5G modem for production in Brazil. The ZTE-Anatel partnership is ongoing.

China Unicom Global (CUG), a Chinese state-owned telecommunications operator, is also developing a large 5G presence in South America. CUG operates in Brazil under its subsidiary China Unicom (Brazil) Telecom Co., which was founded in 2016. Their partnership with privately owned American internet services company Equinix created the foundation for 5G service offerings to expand. Since 2017, Equinix has constructed numerous data centers throughout Brazil, and CUG has begun utilizing them. These data centers, aimed at supporting 5G infrastructure, will bolster CUG’s ability to promote internet connectivity. However, there are few mentions of demarcation points (physical connection points) or other 5G infrastructure terms associated with China Unicom (Brazil) found in open reporting following the initial announcement in 2017. This lack of open reporting suggests that the construction of additional 5G infrastructure could still be in development or delayed.

Figures 5 and 6 display a possible cell tower and 5G point of presence for China Unicom in São Paulo, Brazil as contextual examples of infrastructure types. Although it could not be confirmed that the cell tower represents 5G infrastructure as opposed to 4G infrastructure, the potential security impacts posed by China’s 2017 national security law would be present regardless of which technology the Chinese telecommunications company is implementing.

ARGENTINA

Huawei, ZTE, and other Chinese corporations have played a similarly prominent role in Argentina’s telecommunications sector. The facilities of these two companies are pictured below in Figure 7. Huawei has been present in Argentina since 2001, cementing its role as a top telecommunications provider in the country. According to the Buenos Aires Times, Huawei has been in direct contact with the Argentine Foreign Ministry since 2020 to discuss its 5G implementation. Huawei employed 500 Argentines as of 2020 before 5G implementation began. Huawei leads Argentinian 5G implementation, building on existing 4G frequencies operated by Telecom Argentina. Telecom Argentina has implemented 20 5G sites using Huawei, Nokia, and Ericsson antennae across Argentina as of March 2022. In 2019, ZTE signed a $30 million contract with the Jujuy province to “provide cameras, monitoring centers, emergency services and telecommunications infrastructure.” In a move to bring 5G technology to Argentina, current President Alberto Fernández visited Beijing’s Huawei Technology Center in 2022. Initially, Argentina aimed to have 5G technology running by 2022 or 2023. While 5G tests have begun with Huawei, no official rollout has been announced.

CHINESE SECURITY LAWS POSE RISK TO SOUTH AMERICA’S DATA PRIVACY

In November 2022, the U.S. Federal Communications Commission (FCC) unanimously voted to ban the sales of all Chinese telecommunications equipment and devices manufactured by prominent brands such as Huawei and ZTE, citing the risk to national security. The United States has since urged other countries, especially its allies, to follow suit, arguing that the penetration of Chinese telecom companies into foreign markets threatens the security of host nations and their allies. As such, the growing presence of Chinese telecom companies in Latin America is an issue of international contention.

By the end of 2026, 5G is expected to represent around 43 percent of mobile subscriptions in Latin America, according to the Swedish telecommunications firm Ericsson. As Chinese companies increase their presence in telecommunications networks, their capability for data collection in the host country grows. While the country case studies included in this article have different histories with Chinese telecommunications companies, they all now have prominent 5G investments and capabilities. Though the United States has banned Chinese 5G tech, in other nations it has the potential to create a “digital iron curtain” between the United States and countries accepting Chinese help. As China seeks to assert its influence on the global stage through its Digital Silk Road, a key aspect of the Belt and Road Initiative (BRI), its influence over Latin American communications networks can be leveraged.

5G networks, for all their benefits, pose potential cybersecurity risks. Individuals, companies, and governments using Chinese 5G networks open themselves up to vulnerabilities that can be used to hurt the host country or to benefit China in a number of ways, including intellectual property theft, corporate and interstate espionage, and cyberattacks, including those against utilities grids and communications. Though the United States and its key allies have restricted Chinese 5G technology, the high functionality and low cost have helped growth, especially in lower-income countries. The proliferation of "cheap" Chinese 5G places these states at increased risk of Chinese espionage, intellectual property theft, and cyberattacks. While host states are the primary entities endangered by the use of Chinese 5G technology, the United States is exposed by roaming and network peering deals, as American facilities and American tourists in these host countries become exposed to network vulnerabilities – putting the transmitted data at risk of interception by the Chinese government.

As more countries allow Chinese telecom companies to gain access, China will develop deeper influence in the tech sphere and will gain stronger abilities to capture key information. In the broader context of US-China geopolitical tension over technology races, Latin American policymakers have often adopted a "pragmatic" and "neutral" stance balancing benefits from each alliance. However, in the cases described in this study, there is clear evidence of permitting 5G projects funded by China to flourish. This trend could pose a threat to the influence that the United States has maintained in the region for decades.

Contribution Notes

ArcGIS visualization credit: Sasha Ackerman, Allison Snow, and Christina Ward. James Madison University undergraduates, 2022.

Timeline

Apr 20, 2023

ZTE wins a contract with Unifique, a Brazilian Telecommunications company.

ZTE wins a contract with Unifique, a Brazilian Telecommunications company, in Brazil. ZTE will “provide a 5G kit” for Unifique’s commercial 5G rollout, expected to begin June 2023.Source(s): Data Center Dynamics,

Apr 11, 2023

Brazilian President Luiz Inacio Lula da Silva signs 15 memorandum of understandings with China.

Brazilian President Luiz Inacio Lula da Silva signs 15 memorandum of understandings with China focused on telecommunications, digital developments, and satellite monitoring.Source(s): Mobile World Live,

Feb 03, 2022

China Unicom is banned from providing mobile services to the United States.

China Unicom is banned from providing mobile services to the United States. All of their American domestic services were discontinued on April 4, 2022.Source(s): Federal Communications Commission,

Jan 26, 2021

Brazil will not disqualify Chinese Huawei Technologies Co Ltd from “5G network auctions.”

Former President Jair Bolsonaro announces that Brazil will not disqualify Chinese Huawei Technologies Co Ltd from “5G network auctions.”Source(s): Reuters,

Jun 30, 2020

The Federal Communications Commission flags five Chinese companies as threats to national security.

The American Federal Communications Commission flags five Chinese companies, including Huawei Technologies Co and ZTE Corp, as threats to national security.Source(s): Federal Communications Commission,

Jun 01, 2019

China signs memorandum of understanding with 16 countries.

In mid-2019, China signs memorandum of understanding with 16 countries to strengthen cooperation in advancing the Digital Silk Road and 19 memorandum of understanding on “bilateral e-commerce cooperation.”Source(s): Council on Foreign Relations,

Apr 26, 2019

Second Belt and Road Forum takes place.

President Xi Jinping delivers the keynote speech stressing the desire to “enhance connectivity and practical cooperation.”Mar 01, 2019

ZTE signs a nearly $30 million contract with San Salvador de Jujuy.

ZTE signs a nearly $30 million contract with San Salvador de Jujuy, a province in Argentina, to provide cameras, monitoring centers, emergency services, and telecommunications infrastructure to monitor and surveil crime.Source(s): Reuters,

Nov 14, 2018

ZTE assists Venezuela in the development and deployment of the “fatherland project” (“carnet de la patria”).

The project and ID transmit and collects data about cardholders.Source(s): Reuters,

Dec 01, 2017

The “Standards Connectivity and Join Construction of the Belt and Road Action Plan, 2018-2020” is issued.

This announcement would seek to set “unified standards in 5G, artificial intelligence, satellite navigation, and other technical fields.”Source(s): Council on Foreign Relations,

Mar 28, 2015

China adds a Digital Silk Road component to the Belt and Road Initiative.

The vision for the Digital Silk Road is announced in a white paper published by the Chinese National Development and Reform Commission, the Ministry of Foreign Affairs, and the Ministry of Commerce.

Look Ahead

Latin American 5G proliferation is on the rise with Chinese telecommunications companies becoming increasingly intertwined with Latin American cellular providers and allocating funds toward future infrastructure development. The projected expansion of Chinese 5G networks in Latin America has implications for the security and data privacy sector, including loss of data autonomy for Latin American citizens.

Things to Watch

- Open reporting of data breaches or issues connected to Chinese equipment and services.

- Sentiment analysis (positive and negative) in Latin America regarding Chinese telecom services.

- US statements on 5G infrastructure usage in Latin America if development increases.