Overview

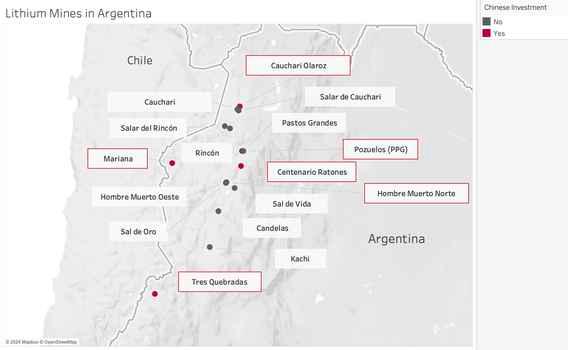

Chinese companies own or otherwise have significantly invested in six of 16 active lithium mining projects in Argentina, including four of the six most developed projects. Investment in these mines helps to further cement the People's Republic of China's dominance and control over the lithium industry, a mineral critical for the green-energy transition, particularly in the construction of lithium-ion batteries.

Seventy-five percent of the world's lithium is contained in the desert salt flats (salars) at the crossroads of Argentina, Bolivia, and Chile, which is known as the lithium triangle.

Activity

This report provides a detailed disposition of ownership and status of Chinese-backed lithium projects in Argentina. GEOINT analysis shows that most declarations from company sources are on-time and progressing often rapidly with a few projects behind scheduled projections.

Background

Lithium has been deemed by the U.S. Department of Energy (DOE) as both a critical material and a critical mineral for having “a high risk of supply chain disruption and serv[ing] an essential function in one or more energy technologies, including technologies that produce, transmit, store, and conserve energy.” DOE also conducts risk assessments, looking at a mineral's value and anticipated access. In the short term (2020-2025), it is a near-critical material given its high value for energy and moderate supply chain risks, but in the long term (2025-2035) it moves to critical as the risks to the supply chain increase. Lithium is in high demand and will only likely increase as it is a key component in lithium-ion batteries, necessary for green energy transitions.

Seventy-five percent of the world’s lithium is contained in the desert salt flats (salars) at the crossroads of Argentina, Bolivia, and Chile, which is known as the lithium triangle. While the People’s Republic of China (PRC) controls over 50% of the world's lithium refinement capability, it is seeking to secure greater access to raw lithium, currently controlling about 25% of global mining capacity. To do so, it is increasingly using state-owned enterprises and encouraging private enterprises to invest in the lithium triangle, including in northern Argentina.

Scope of Investment by PRC Companies

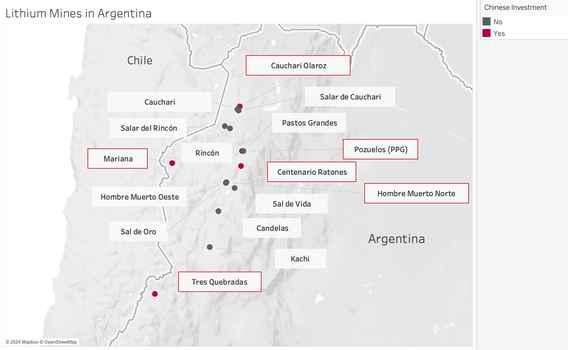

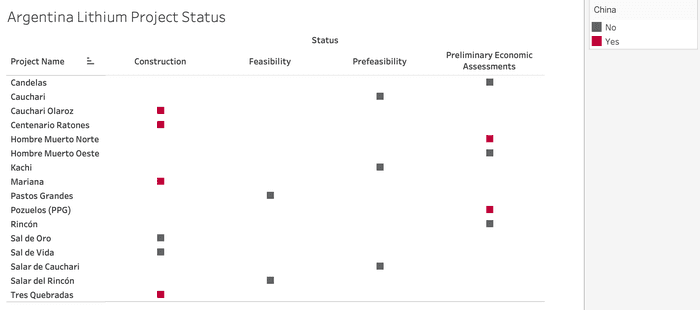

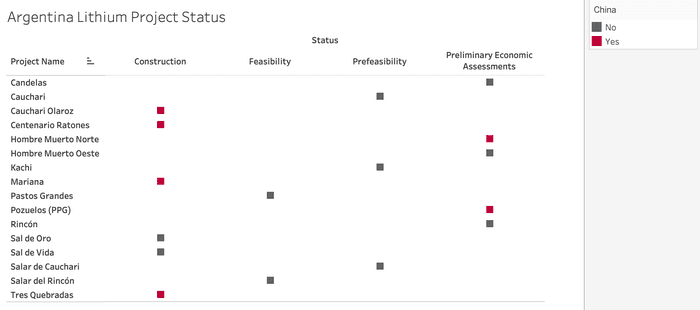

According to Argentina’s Ministry of the Economy, as of February 2023, there are 16 lithium projects beyond advanced exploration in either the construction, feasibility, pre-feasibility, or preliminary economic assessment stages. Six of the projects are owned in full or in part by a Chinese company, including four of the six most developed projects (see Images 1a, 1b). Ganfeng Lithium operates three projects while Zijin Mining Group, Tsingshan Holding Group, and Sino Lithium Materials are each involved with one project. According to the estimates published by Argentina's Ministry of the Economy, once each site is producing, the total estimated average annual production of these six sites is 119,000 t/LCE, enough to cover 88.8% of the estimated 2022 global consumption of lithium. Ganfeng Lithium and Tibet Summit Resources also have announced investment into two other projects each that are in earlier stages of development.

This report will analyze six Chinese-backed projects using commercial imagery and open press and business reporting.

In northern Argentina, by virtue of its elevation, sunshine, and lack of precipitation, lithium is mined through evaporation in 15 of the 16 projects. The process begins with wells that pump lithium-rich brine into shallow ponds on the surface where the mixture sits. Over time as the water evaporates, it leaves lithium behind that is chemically processed and refined. While evaporation is the most common method of mining lithium, it is highly inefficient, time consuming, and water-intensive. Local indigenous communities are protesting the development of lithium mines as it drains critical water resources and disrupts their primary forms of income: tourism and salt mining. In 2010, a group of indigenous peoples in Jujuy and Salta provinces began a legal battle with provinces over the right to consent to mining. Constitutional reform efforts during the summer of 2023 decreased the protections on protest and paved the way for greater access to land at the expense of indigenous communities. The passage of the reforms in under three weeks led to protests that were repressed in an internationally denounced crackdown on speech and protest.

The other project, Centenario Ratones, mines lithium through a similar process of brine pumping but then is processed through chemical absorption, decreasing the amount of brine needed and allowing water to be recycled. This process is touted by Eramet, the company that developed it, as able to produce lithium in 24 hours, as opposed to the sometimes 18-month evaporation process.

Ganfeng Lithium

Ganfeng Lithium was founded in 2000 and is now listed on the Shenzhen Stock Exchange and the Hong Kong Stock Exchange with 16 active lithium projects in six countries on six continents. In Argentina, they have five projects underway, three of which go beyond advanced exploration. Ganfeng Lithium's partner, Lithium Argentina, announced in June 2023 that its Caucharí-Olaroz project is producing lithium, while the Mariana Salt Lake project at Salar de Llullaillaco and the Pozuelos-Pastos Grandes project are under construction. The Mariana project held its groundbreaking ceremony on May 30, 2022 and Ganfeng Lithium's work on the Pozuelos-Pastos Grandes project began when it was purchased in October 2022. Furthermore, Ganfeng Lithium is conducting exploratory drilling at Salar de Incahuasi and another project at Salar de Pastos Grande.

Caucharí-Olaroz Project

The Caucharí-Olaroz project is a joint venture between Lithium Argentina (44.8%), Ganfeng Lithium (46.7%), and Jujuy Energía y Minería Sociedad del Estado (JEMSE) (8.5%) that is operated through a local holding company, Minera Exar. While Lithium Argentina is a separate company, on February 26, 2024, it announced that it had appointed a new president and CEO, Sam Pigott, who is "a member of the senior leadership team of Ganfeng Lithium." Ultimately, Ganfeng Lithium anticipates investing $641 million in the project which it projects will produce 40,000 tons per year of lithium carbon. Lithium America's (Lithium Argentina's precursor company) announced on the company's website the plant was producing on June 12, 2023.

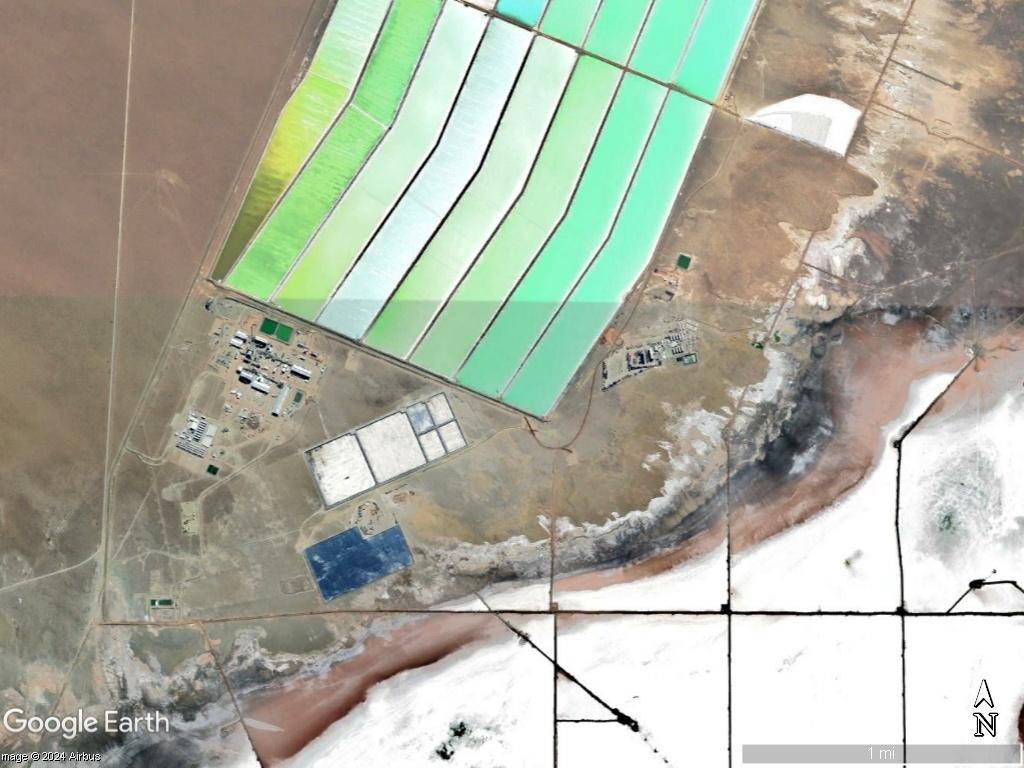

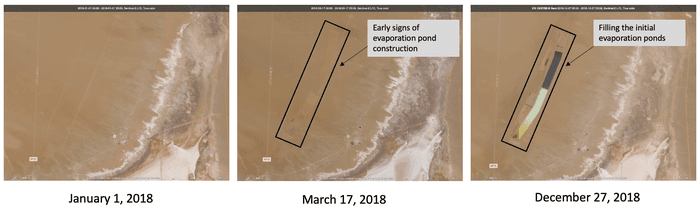

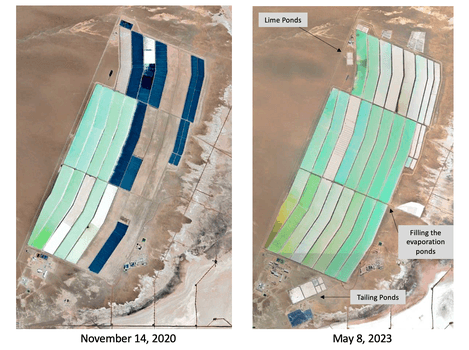

In 2019, Ganfeng Lithium announced $160 million investment in the Caucharí-Olaroz project. According to Lithium America's September 2023 corporate presentation, it began exploration of the site in 2009 and the feasibility study and environmental permits for the site were approved in 2012. Imagery analysis reveals that construction and filling the brine ponds began in 2018 as shown in Image 2 below.

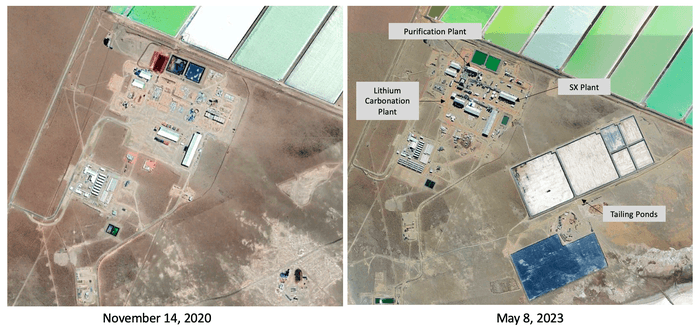

In 2020, Lithium America announced that Ganfeng Lithium expanded its investment, and imagery analysis reveals further work was done building the evaporation ponds, lime plant, refining capabilities, and tailing ponds (Image 3 and Image 4). In July 2022, Ganfeng Lithium stated that it anticipated the operation of the Caucharí-Olaroz plant to begin by the end of the year, however, it did not begin until June 2023, a delay of approximately six months.

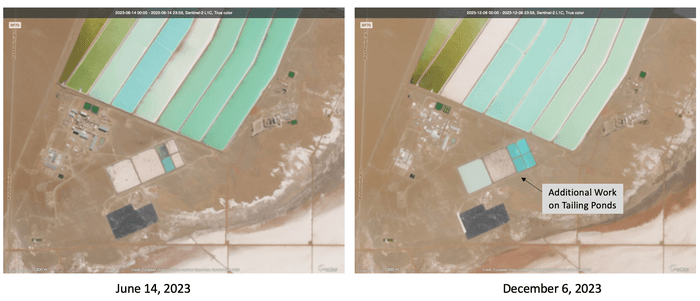

During the public announcement of initial production, Lithium America stated that “[a]dditional purification processing equipment necessary to achieve battery-quality lithium carbonate is expected to be completed in the second half of 2023, as planned.” Since then, according to imagery analysis, additional work has been done on tailing and mother liquor ponds (see Image 5). When Lithium Argentina announced the 2023 production results for Caucharí-Olaroz in January 2024, it stated the lithium carbonate plant is running at 50% capacity and will ramp up production to capacity throughout 2024.

Mariana Project

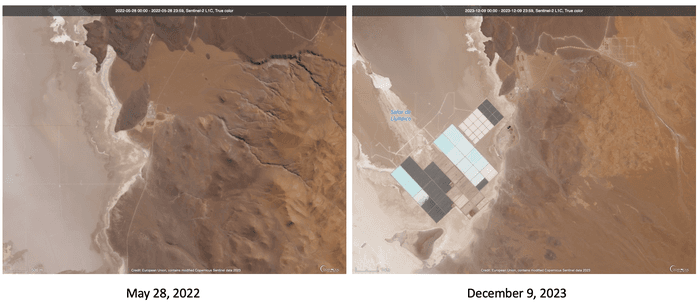

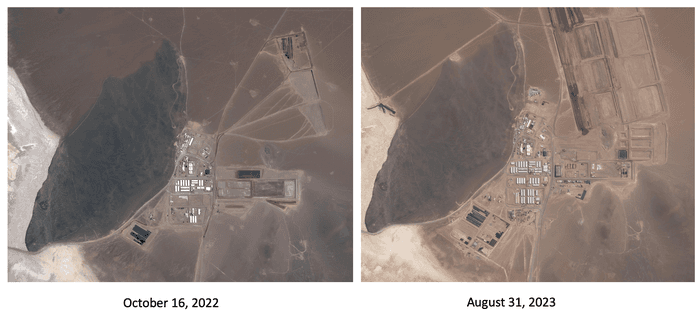

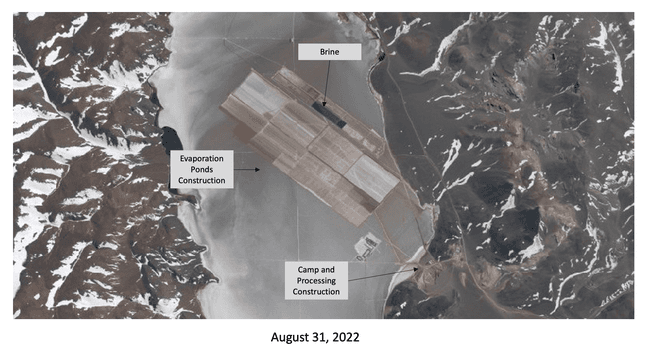

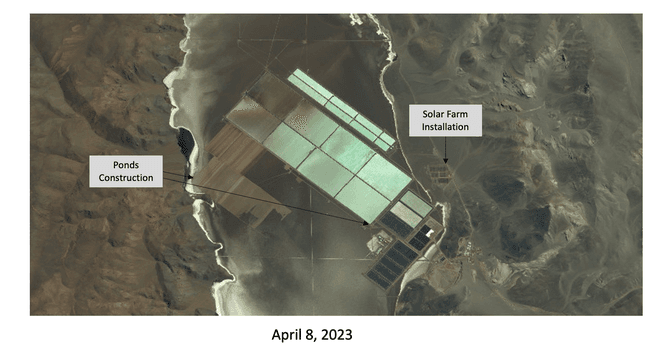

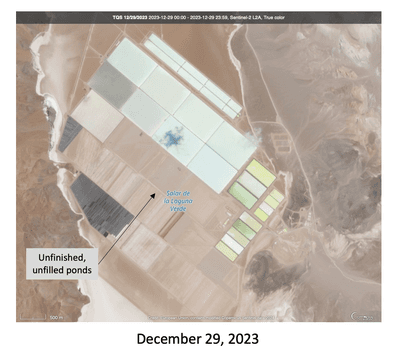

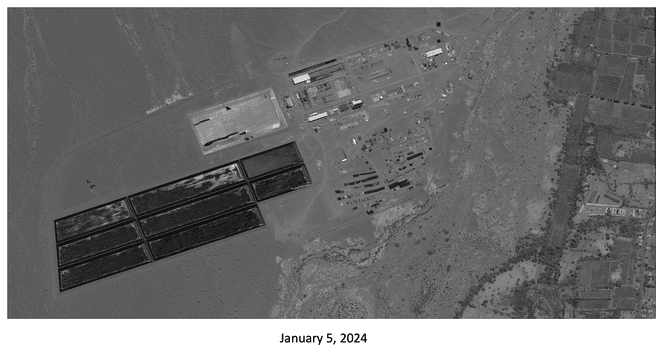

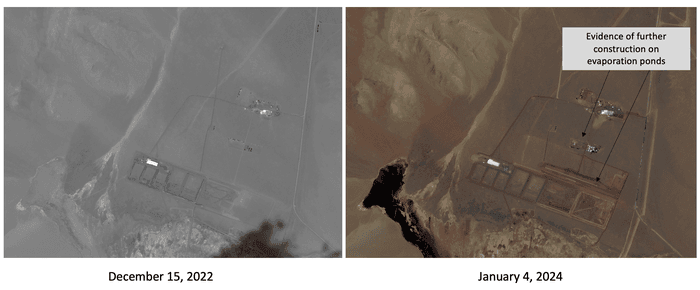

The Ganfeng Lithium project at Salar de Llullaillaco (the Mariana Project) is operated through a local subsidiary, Litio Minera Argentina S.A. with Ganfeng holding a 100% equity share. In June 2021, the environmental impact study was approved proceeded by the groundbreaking ceremony on May 30, 2022 (left image, Image 6). The ceremony was attended by local officials and the PRC ambassador to Argentina, Zou Xiaol, participated virtually. Since then imagery analysis reveals that work has continued on the evaporation ponds (Image 6) as has construction on the camp and lithium processing facilities (Image 7). In their 2022 Annual Report, Ganfeng Lithium announced that the project is expected to begin production in 2024. However, the most recent imagery shows that the evaporation ponds are not yet completed (Image 6). The ponds are located approximately 1000 meters southwest of the base or camp.

Pozuelos-Pastos Grandes

The Pozuelos-Pastos Grandes (PPG) is operated through a local subsidiary, Lithea Inc, which Ganfeng Lithium acquired in late 2022. Ganfeng Lithium announced that construction had begun on PPG at an end-of-year presentation to its shareholders according to reports by Shanghai Metals Market (which provides information on metal markets) and MooMoo (a trading platform). Ganfeng Lithium also announced on its PRC-based website that the pilot project produced lithium by the end of 2023 and that "salt field construction scheduled to commence at the end of 2023 and production expected to start in 2026." With that announcement, the pilot plant is outpacing its initial production targets, as the target production date on Ganfeng Lithium's Latin America website is 2024.

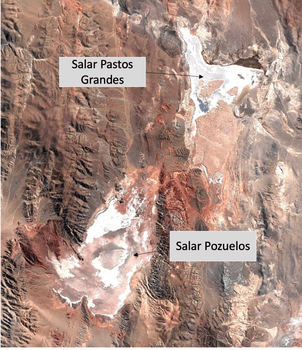

The project covers two salars, Salar Pastos Grandes in the north and Salar Pozuelos in the south (Image 8). According to the original feasibility study completed by Lithia and submitted in January 2019, the salars will be connected by a brine concentration pipeline with the processing plants and brine ponds to be constructed in and around Salar Pozuelos.

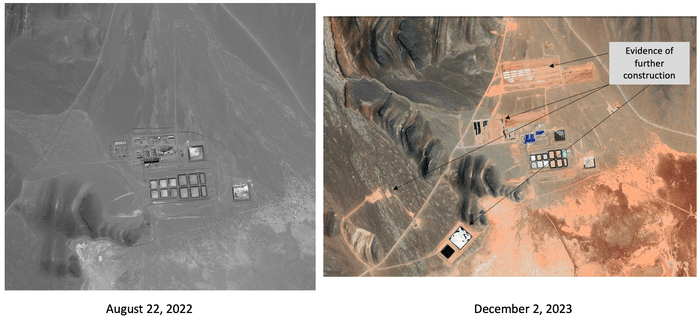

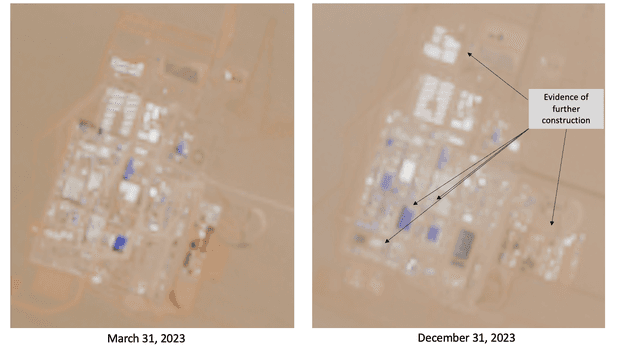

From August 2022 to December 2023, imagery reveals there has been some minor construction on the processing facilities and camp on the north side of Salar Pozuelos (Image 9).

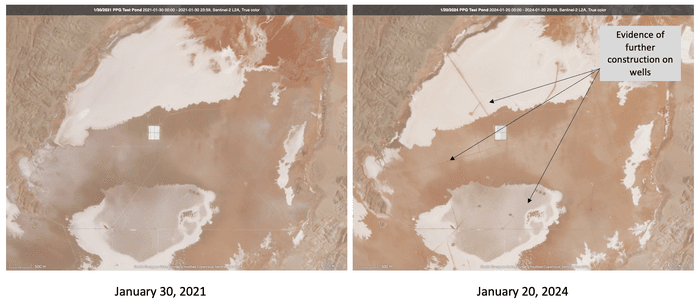

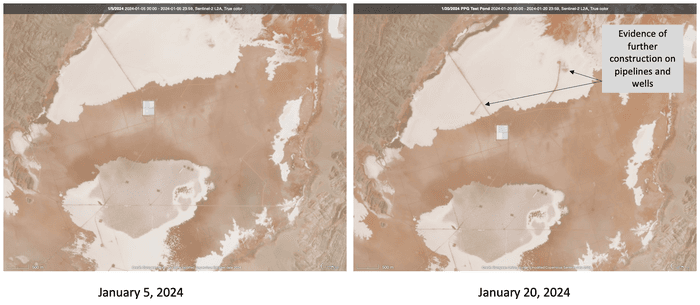

As stated above, Ganfeng Lithium had announced construction on the salt flat would commence by the end of 2023. Beyond the initial test pond that has been filled since at least January 2021, imagery analysis does not reveal evidence of additional construction on evaporation ponds (Image 10). However, it does show construction of additional wells and installation of pipes since 2021 (Image 10). Furthermore, imagery analysis reveals that the site continues to be under construction with additional well and pipeline infrastructure observed in the January 2024 (Image 11).

Tsingshan Holding Group

Centenario Ratones

Tsingshan Holding Group acquired 49.9% ownership in the Centenario Ratones owned by a French company, Eramet. The cash injection kickstarted the project again after it had been shuttered in 2020 due to the effects of COVID-19. The project serves as the pilot project for Eramet’s innovative chemical mining process.

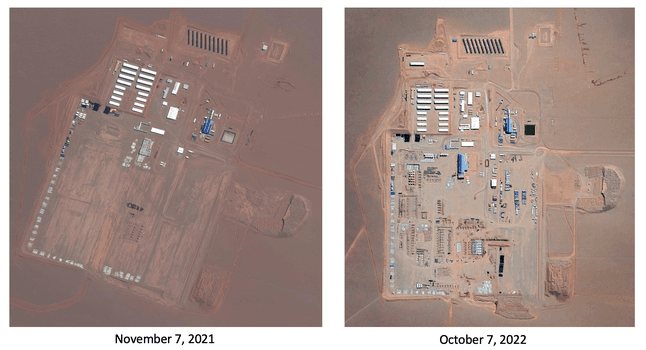

Construction on the chemical processing plant began in May 2022 with Eramet setting its target production date of early 2024. In March 2023, Eramet announced on its website that it anticipates commissioning the first plant in November 2023, processing the first ton of lithium in 2024, and reaching full capacity by 2025. After the Tsingshan investment, construction on the facilities increased rapidly, according to imagery analysis (Image 12, Image 13).

Eramet did not announce that it had met its previously stated goal of commissioning the plant in November 2023 and it is unclear if it will be able to receive and process lithium on schedule in early 2024. However, the latest satellite imagery available from December 2023 shows further construction of the processing plant (Image 14).

Zijin Mining Group

Tres Quebradas Salar

Zijin Mining Group obtained the rights to Tres Quebradas Salar in 2022 through the acquisition of the local subsidiary, Liex. Zijin Mining stated that it expected that production was anticipated by the end of 2023 with a scheduled second phase of construction to increase capacity after. The project has two main sites, a mining and early processing facility at the salar itself and the lithium processing facility just outside the city of Fiambalá.

According to imagery analysis, by August 31, 2022 development of the evaporation ponds, processing facility, and workers camp increased rapidly at the salar (Figure 15).

By mid-2023, the evaporation ponds were at least partially dug and the first pools filled and progress was made on the construction of a solar power grid, according to imagery analysis from August 2022 to April 2023 (Image 16).

However, based on imagery analysis from December 2023 the construction and filling of the evaporation ponds had not been completed by the end of 2023, when the Zijin had initially announced the site would be producing (Image 17).

At the same time, production continued at a dedicated lithium production plant just outside the nearby city of Fiambalá. The Fiambalá site houses the Lithium Carbonate Plant, the discard ponds, and other supporting installations (Image 18).

Sino Lithium Materials & Chengdu Chemphys Chemical Industry Co., Ltd.

Hombre Muerto Norte

In 2017, Lithium South precursor company, NRG Metals, entered into a conditional off-take agreement with Chengdu Chemphys Chemical Industry Co., Ltd. ("Chemphys"), an agreement that gave them the right "for the sale of any lithium produced at HMNLP, as well as a first right of refusal and first right of offer for the sale of lithium produced at any other projects that NRG moves forward, board representation and certain anti-dilution provisions and a use of proceeds agreement." In April 2020, NRG announced that Sino Lithium Materials and Chemphys developed a "proprietary lithium extraction process" which "has the potential to significantly increase lithium recovery and reduce the production lead time compared the conventional processes" and that would be tested at Hombre Muerto Norte. Since the announcement of the proprietary lithium extraction process, imagery analysis does not reveal any construction on the site's evaporation ponds (Image 19).

According to Lithium South's September 2023 corporate presentation, two of the Lithium South directors are Chemphy's employees and Chemphy's has "an 11-member technical team working full time on development of the Direct Lithium Extraction Technology" for Lithium South, a new form of lithium extraction. Lithium South filed its technical report in November 2023 and in January 2024, it announced it was nearing the end of its preliminary economic assessment.

Timeline

Oct 14, 2022

Ganfeng Lithium Announces Pozuelos-Pastos Grandes Investment

Source(s): Ganfeng Lithium PPG Announcement,

Feb 04, 2022

Zijin Mining Announces Investment in Tres Quebradas project

Source(s): Reuters Reporting,

Nov 08, 2021

Tsingshan Holding Group Acquires a Stake in Centenario Ratones

Source(s): Eramet Announcement to Restart Construction,

Jan 01, 2019

Ganfeng Lithium Invests in Caucharí-Olaroz Project

Source(s): Caucharí-Olaroz Corporate Presentation,

Graphs

Look Ahead

There are at least three other announced projects by Chinese companies, including an additional investment by Ganfeng Lithium at Salar de Incahuasi and two by Tibet Summit Holding, at Salar Arizano and Salar de Diablillos. However, these projects were not included in any detail in the 2023 list of lithium mines from the Argentinian Ministry of Economics due to being in the very earliest stages of exploration.

Things to Watch

- Will the economic policies of the new Argentinian President Javier Milei fuel or discourage further economic investment in Argentina?

- How will global lithium markets respond to a coming influx of lithium?