Overview

Chinese investments in Russian Arctic energy projects are facing complications due to sanctions on Russia.

Western sanctions against Russia due to their invasion of Ukraine have resulted in delays to the joint Russia-China Arctic Liquified Natural Gas 2 project. Sanctions appear to be impacting Chinese companies' ability to secure specific western technologies used in LNG processing structures known as "trains" and access to mostly western company-owned and operated ice-hardened transport vessels capable of moving the trains from China to the Arctic.

Activity

This report uses commercial imagery and open reporting to examine Chinese liquified and natural gas (LNG) investments in the Russian Arctic to illuminate the nature of China and Russia's complicated economic relationship and China's Arctic ambitions.

Bottom Line:

To fuel further economic growth and diversify its energy imports, China has made critical investments in Russian liquid natural gas (LNG) projects in the Arctic. Chinese firms provide both financial capital and outsourced construction to make these projects possible. China's first investment, a joint project with the Russian energy company Novatek, known as Yamal LNG, was completed in 2017. The success of this first project encouraged China to partner with Novatek again for a more ambitious project dubbed Arctic LNG 2. In this project, Chinese firms not only invested but are heavily involved in fabricating key components. But progress on Arctic LNG 2 slowed and in some places was halted altogether following Russia's invasion of Ukraine. Despite project owner Novatek stating that the first modules for the project's second phase were to arrive in Murmansk in May 2022, imagery analysis shows that as late as September 2022, many of the Chinese-manufactured modules were still sitting in Chinese docks.1

This report captures images from four Chinese construction companies and Novatek's construction yard to demonstrate module construction and transport of components necessary for Arctic LNG 2 is behind deadlines, indicating that one of China's most important forays into the Arctic may be at risk.

Background: China's Arctic Ambitions

China's growing economy and limited energy resources make it the world's leading importer of oil and natural gas. Approximately 80% of these resources pass through the Strait of Malacca, controlled by the US-aligned Singapore, resulting in a potential choke point that the U.S. could leverage against China. This "Malacca Dilemma" drove China to diversify its import sources in order to improve its energy security.

In order to achieve this, China seeks a closer economic partnership with Russia, particularly regarding access to Russia's energy deposits above the Arctic Circle. As climate change increases access to the Russian Arctic, China is seeking leverage in the region through investments by Chinese state-owned enterprises (SOE). These investments come at a fortuitous time for Russia as Europe piles sanctions on Russian energy. Chinese SOEs are filling the funding gap that Europe is leaving behind.

China's goals extend beyond energy. Despite having no territory in the Arctic, China seeks to establish itself as a key actor in Arctic affairs. While China is not one of the eight nations that possess territory in the Arctic, it claims to have an important stake in the region and calls itself a "near Arctic state."

These investments also develop China's relationship with perhaps its most important geopolitical partner: Russia. Russia's need for economic support in the face of new sanctions combined with China's need for energy and Arctic influence make them logical partners. These overlapping interests offer an opportunity to test their "no-limit partnership."

By providing critical capital and outsourced labor, China supports Russian firms in their development of Arctic infrastructure while also pursuing core Chinese national interests.

China's First Big Investment: Yamal LNG

China's first practical effort at achieving its Arctic energy goals was its investment in Novatek's Yamal LNG project in 2013 (fig. 1). Located at Sabetta on the Yamal Peninsula, Yamal LNG started in 2005 when Novatek purchased the gas field it sits on from Tamanneftegaz (website not secure), a Russian energy and logistics company operating in the Arctic. The project is a joint venture, with an array of actors. Yamal LNG's investment breakdown shows Novatek with a majority 50.1% stake and Chinese firms with a 29.9% stake. A French company, TotalEnergies, holds a 20% stake.

Yamal remains operational as of 2022, however its exports to Europe, currently its most important customer, have declined by 13% month per month as European countries move away from importing Russian energy due to sanctions.

ARCTIC LNG 2

Background

Given the seeming success of Yamal, China also invested in Arctic LNG 2, Novatek's second project in the Arctic (fig. 2). LNG 2 is situated on the Utrenneye Field across the Gulf of Ob from Yamal LNG. Chinese firms own a 20% stake in the project, making them Novatek's largest partner. A consortium of Japanese companies own a smaller 10% stake and French TotalEnergies the remaining 10%. However, these firms came under pressure to relinquish their involvement after Russia's invasion of Ukraine. TotalEnergies announced its exit in March 2022. Japanese firms, while more hesitant to exit, either suspended or wrote off their involvement.

While Arctic LNG 2 is not yet operational, Chinese firms already contracted for its future supply. In 2021, three Chinese SOEs signed contracts for close to 40 million tons of LNG over 20 years from the facility.

Planned Progress vs. Reality

Construction on Arctic permafrost is difficult and resource intensive. To mitigate both the environmental and fiscal challenges, the plan is for Arctic LNG 2's components to be fabricated in Russia and China, transported to the Arctic, and then constructed atop gravity-based structures (GBS).

- A train is a complex structure that intakes raw gas condensate and transforms it into pure liquid natural gas. Each Arctic LNG 2 train is designed to produce 6.6 metric tons per annum (MTPA) of LNG, for a total 19.8 MTPA of LNG for the whole project.

- A train consists of fourteen modules, which are massive, prefabricated structures that facilitate the rapid construction of LNG processing plants. The Arctic LNG modules are being constructed at up to seven yards—one in Murmansk, Russia, and as many as six in China—and then shipped to Murmansk for installation on the concrete foundations.

- Project subcontractors are constructing the GBS foundations in two dry docks at Novatek's construction center in Murmansk.

By comparing the design concepts published by Novatek with commercial imagery, we assess that construction of the components largely proceeded as scheduled, but their transport to the Arctic is delayed.

The design concepts are shown in Figures 3 a and b below.

Using the images in Figure 3 as a benchmark for measuring progress on LNG Train 2, we assess that:

- The modules are too heavy for a crane and must slide onto the GBS, so they must be installed in order from back to front, as demonstrated in Figure 4a.

- There is limited space at Novatek's construction yard to temporarily store modules before they are installed. As such, with two known exceptions, the order in which modules are shipped generally follows the order in which they are installed.

- Trains 1 and 2 are the same design and the Chinese fabricators are building the same modules for both, so the order of shipments is likely to be the same.

Delayed Transport from Chinese Module Manufacturers

Based on the insights gleaned from the concept plans, we evaluated imagery and press releases from Chinese firms to determine whether the projects were proceeding as planned. While much of the fabrication at the Chinese and Russian facilities is complete, we assess that transport to the Arctic is delayed.

Wison Offshore Engineering Module Development (Zhoushan, Zhejiang)

Coordinates: 30°11'25.61"N, 122°12'9.59"E

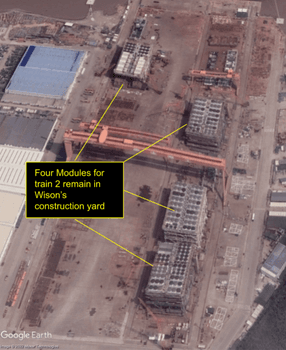

Wison's contributions to Arctic LNG 2 form the core of each LNG train's module assemblage and thus must be installed first, as evidenced by the construction of Train 1. Despite a predicted installation date of May 2022, Wison's second batch of modules bound for Train 2 was still in the construction yard in August 2022, providing imagery evidence that Arctic LNG 2 is behind schedule.

Wison appears to be responsible for constructing at least eight modules in total. The first four modules (fig. 5) were shipped in August and September of 2021 (fig. 6).

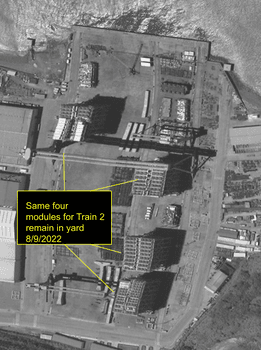

In May, 2022, the month Novatek predicted modules would begin arriving, Wison had four modules intended for Train 2 remaining in their construction yard (fig. 7a). Using the imagery of Train 1 as a reference, these modules appear to be complete (fig. 3c). As of August 9, the modules have still not shipped (fig. 7b).

Given their place at the beginning of the installation order, their continued presence at Wison until at least August 2022 indicates Novatek is approximately three months behind its goal of beginning Train 2 module installations. However, given that Cosco Heavy Transport is currently transporting other modules that come later in the installation order, it is possible that these modules have shipped since August 9, 2022 (latest available imagery).

Bomesc Module Development (Harbor Economic Area, Tianjin)

Coordinates: 38°56'9.96"N, 117°45'28.27"E

Bomesc's contributions to Arctic LNG 2 are mostly complete. All of its Train 1 modules are installed and two of its Train 2 modules shipped. But there is one module that remains in its construction yard and industry news sources imply that this module is unlikely to move in the near term, further indicating that construction of Train 2 is behind schedule.

Bomesc was contracted to construct a total of six modules for the project: three for Train 1 and three for Train 2. Two modules for Train 1 shipped in December 2021, aboard the Cosco Shipping-owned vessel Xin Guang Hua and arrived in mid-January, 2022 (fig. 8). Because of assembly requirements at Murmansk, a third Train 1 module shipped almost concurrently onboard the Red Box Energy Services vessel Audax via the Northern Sea Route, arriving in early February 2022 (fig. 9).

On August 16, 2022, it was reported that two completed modules for Train 2 were loaded onto the Cosco-owned ship Xin Guang Hua. Cosco is moving quickly to deliver these modules before its contract with the project expires. Maritime tracking websites indicate that the Xin Guang Hua is en route from China to Murmansk, with an estimated arrival date of October 18, 2022.

As of September 9, 2022, one module bound for Train 2 remains in the construction yard (fig. 10). Since Bomesc's Train 1 modules all shipped at nearly the same time because of assembly requirements in Murmansk, this module's continued presence in Bomesc's construction yard may further indicate that the construction of Train 2, and thus the project, is behind schedule.

Penglai Jutal Offshore Engineering (Penglai, Shandong)

Coordinates: 37°48'48.65"N, 120°50'19.41"E

PJOE's modules for Arctic LNG 2 appear complete, but an absence of typical social media updates about its progress may indicate delays in transport.

PJOE is contracted to construct a total of six modules for Trains 1 and 2; Figure 11 shows all six modules under construction in April 2021. According to a PJOE press release and YouTube video, two modules destined for Train 1 shipped on November 6, 2021, while a third shipped on November 27, 2021. Imagery from December 2021 confirms these shipments (fig. 12).

Based on key identifiers taken from reference images of Train 1 (fig. 13a), the most recent available imagery (March 5, 2022) indicates the three modules for Train 2 were complete (fig. 13b).

While module construction may be complete, PJOE has not publicly noted progress on the project since December 2021. Prior to that, PJOE posted press releases on its website touting its progress on the project frequently, including when the first modules shipped. It also posted regular and enthusiastic updates on YouTube and LinkedIn on project status. This sustained silence could be an indicator that progress has stalled. It's also possible that PJOE is no longer seeking publicity for its partnership on a Russian project.

Qingdao McDermott Wuchuan Module Development (Qingdao, Shangdong)

Coordinates: 35°59’12.65” N, 120°16’41.97” E

Delays in transport also affect Qingdao McDermott Wuchuan. While two modules for Train 1 appear to have shipped, as of May 23, 2022, one module for Train 2 remains in the yard–behind Novatek's schedule.

McDermott was contracted to construct three liquefaction modules for the project, with two modules bound for Train 1 and the third bound for Train 2 (fig. 14). Figure 14 is from May 2021 and shows the two modules for Train 1 with the module for Train 2 in the early stages of construction evidenced by the multiple module decks waiting to be crane-lifted into position. Two of these shipped in November and December 2021.

However, as of May 23, 2022 (latest available imagery), one module intended for Train 2 remains at the McDermott Construction Yard (fig. 15). The module appears largely complete, with little visible construction activity occurring around it.

As modules remain in Chinese construction yards, their assembly into trains is further delayed. The next section uses imagery analysis of Novatek's own construction yard, where these modules are turned into LNG trains, to further demonstrate Arctic LNG 2's delays.

Novatek Construction Yard at Murmansk (Belokamenka, Murmansk Oblast)

Coordinates: 69°05′N 33°12′E

Imagery from July 2022 (latest available imagery) of Novatek's construction areas indicates that Train 1 is prepared for final transport to the Arctic but Train 2 is not. Novatek's plans were to begin module installation in May 2022.

Once the Chinese construction yards finish their modules, they are transported to Novatek's Belokamenka construction yard near Murmansk, Russia, where construction of the GBS foundations is occurring in two dry docks (fig. 16). Because of the size of the modules, they are skidded onto the GBS foundations via a sled system. We used the presence of these sleds at the dry docks to assess whether the LNG train was complete.

As of July 15, 2022, Novatek was flooding Train 1's dry dock and the sled used for positioning modules was removed, indicating that the train was being prepared for departure. However, in spite of Novatek's predictions that modules for Train 2 would begin arriving in May 2022, Train 2 appears to have made little progress beyond its concrete foundation (fig. 17) as a result of module delays.

Arctic LNG 2's Troubled Future

Since the beginning of Russia's 2022 invasion of Ukraine, progress on Arctic LNG 2 has slowed. Western-based and western-aligned companies involved in contracting (TechnipFMC and Saipem), construction (Boskalis), and various critical, long-lead technologies (Baker Hughes, Seimens, Linde, and Daewoo), have all ended or are in the process of ending their contracts with the project. Some companies, like Technip, have sought to end all activities in Russia. Technip announced its full exit from the project in October 2022. Even major stakeholders Total S.A. and Matsui have written off the project and will no longer provide additional funds. Additionally, sanctions have likely precluded many of the leading, western-based, heavy-lift companies contracted to transport the modules from China to Murmansk, including Red Box Energy Services, BigLift, and GPO, from participating in the project. Many of these companies specialize in heavy-transport vessels with ice-breaking capabilities, which enabled module transport via the Northern Sea Route (NSR), even in the winter. Without them, the Northern Sea Route may become much less accessible, which could slow progress.

This exodus of western companies has left Novatek with gaping holes in the project that it is struggling to fill. This has led Novatek to try to partner with companies like Turkish energy and construction company Karpowership, NIPIgaz-owned Nova Energies, and Green Energy Solutions out of the UAE. Recent news releases indicate Karpowership is considering potential involvement but has not yet signed on.

On the module transport side, while Cosco Heavy Transport and other Chinese companies have participated in the project, it remains to be seen whether they or other non-western, heavy-lift companies can fill the void left by western companies.

These complications have led to significant delays in the project's progress. Though Train 1 was anticipated to move in the end of 2022, recent industry news articles indicate that Novatek has delayed plans to move Train 1 out of Murmansk until the Summer of 2023.

Note

- Imagery assessments were made with the best available imagery. Some analysis was based on imagery from May and July 2022 and others assessments were from more recent imagery such as from September 2022. Taken aggregately and mixed with open reporting, we argue with moderate confidence that the major trend of shipping delays holds since the February 2022 Ukraine invasion and the sanctions that followed thereafter.

Timeline

Oct 18, 2022

Estimated date of arrival for fourth and fifth Bomesc modules

At time of writing, the Cosco shipping vessel Xin Guang Hua is in transit from China to Murmansk via the Suez Canal.Source(s): Upstream Online, Marine Traffic,

May 27, 2022

Sanctions Deadline for deliveries to Russia

The date named in the sanctions package for when European companies needed to cease deliveries to Russia.Apr 21, 2022

Novatek CEO casts doubt over Arctic LNG 2’s future at 2022 Annual Meeting of Shareholders

Source(s): The Barents Observer,

Apr 08, 2022

European Sanctions package on Russia

Ordered all European companies to conclude outstanding deliveries by May 27. Leads to Chinese fabrication yards coming to a halt.Source(s): High North News,

Feb 24, 2022

Russian Invasion of Ukraine

Feb 17, 2022

Third Bomesc module arrives in Murmansk

Netherlands-based company Red Box Energy Services delivers module aboard the heavy-lift, ice-breaker vessel Audax, via the Northern Sea Route.Source(s): Novatek Facebook Page,

Feb 07, 2022

First two Bomesc modules arrive in Murmansk

Approximate date of arrival. Modules delivered aboard the Cosco-shipping, heavy-lift vessel Xin Guang Hua.Source(s): LNG Prime,

Feb 07, 2022

Two modules constructed by Bomesc Offshore Engineering arrive in Murmansk

Source(s): LNG Prime,

Nov 27, 2021

PJOE ships third module to Murmansk

Nov 06, 2021

PJOE ships two modules to Murmansk

Oct 17, 2019

Penglai Jutal Offshore Engineering announces contract to construct modules for Arctic LNG 2

Source(s): Offshore Engineer,

Sep 17, 2019

Qingdao McDermott Wuchuan awarded module fabrication contract

Source(s): Qingdao McDermott Wuchuan,

Oct 01, 2018

Front-end engineering design (FEED) for Arctic LNG 2 was completed and site preparation began

Source(s): Novatek,

Feb 20, 2014

Russian Invasion and Annexation of Crimea Begins

Jun 21, 2013

The state-owned China National Petroleum Company (CNPC) buys a 20% stake in the Yamal LNG

Source(s): Bloomberg,

Look Ahead

We recommend tracking the construction and shipment of Chinese modules for Arctic LNG 2 to assess how recent sanctions on Russia impact Chinese investments. Analysts should keep an eye out for future Chinese investments in the Russian Arctic to track the growing Sino-Russian economic and energy partnership as well as China's ambitions to become an important Arctic stakeholder.

Things to Watch

- When (if at all) will these modules be shipped to Murmansk?

- Could future Russian activities bring new sanctions and put pressure on the Western companies to withdraw / delay construction otherwise?

- Will China invest in energy projects in other countries to make up for the delays in Arctic LNG 2?