Overview

Though Chinese "Belt-and-Road Initiative" (BRI) investments and related economic activities abroad have been a touchpoint for international studies, this report poses a hypothetical "what if" scenario and seeks to address one facet of the potential implications if Chinese facilities abroad are used for dual-use military/civilian purposes.

The current strategic environment has placed the United States and its allies on a seemingly inexorable path towards confrontation with the People's Republic of China. Given the close relationship between Chinese corporations and military entities, based on the concept of Military-Civil Fusion, this report addresses the hypothetical implications of the military use of seventeen civilian (BRI related) ports with respect to eight identified critical maritime chokepoints.

Activity

To accomplish the goals stated above, an analysis of open source imagery to assess the type of threats that could be hosted at seventeen BRI ports utilizing both military and civilian shipping as transport has been conducted. The implications and extent of these threats have been graphically superimposed over maps of strategic sea routes to visually reinforce the extent of the potential future strategic obstacles. Consequently, it is assessed that Chinese BRI developments could theoretically pose a threat to seven of eight identified critical maritime chokepoints. However, as a caveat to this conclusion, there are a multitude of factors that serve as obstacles to the realization of this hypothetical end-state.

1. Key Intelligence Question

In the event of a Great Power Conflict, what Chinese maritime investments and developments abroad potentially threaten U.S. and Allied maritime capability via the reinforcement and denial of sea space immediately surrounding critical maritime chokepoints?

2. Key Judgement

It is currently assessed that the pre-placement of threat capabilities at the identified Belt and Road Initiative-related maritime infrastructures would enable the PRC to deny freedom of navigation to U.S and Allied maritime activities via all of the identified critical maritime chokepoints, with the exception of the Panama Canal.

3. Framing the Discussion

3.1 The Underlying Trend: The Thucydides Trap.1

Thucydides, in the aftermath of the Peloponnesian War, stated, "what made the war inevitable was the growth of Athenian power and the fear which this caused in Sparta."2 Ultimately, his statement has come to represent the idea put forward by Harvard Professor Graham Allison, that "rising powers tend to come into conflict with those whose strength is long established."3 Indeed, so powerful is this concept that in 2015 President Xi Jinping stated "There is no such thing as the so-called Thucydides trap in the world." But should major countries time and again make the mistakes of strategic miscalculation, they might create such traps for themselves."4 In the same speech Xi Jinping states, "We want to see more understanding and trust, less estrangement and suspicion, in order to forestall misunderstanding and miscalculation." However, in an earlier speech, from 2013, Xi Jinping notes that "in the economic, technological, and military domains" his country would need to prepare for "a long period of cooperation and of conflict" with the expressed aim of "building a socialism that is superior to capitalism, and laying the foundation for a future where we will win the initiative and have the dominant position."5 To understand the full dynamics of this strategic situation, it is important to comprehend the extent of the factors in play.

3.2 The Strategic Environment

In 2018, the United States Department of Defense's (DOD) National Defense Strategy stated that the "re-emergence of long-term, strategic competition between nations" has driven the realization that "inter-state strategic competition, not terrorism, is now the primary concern in U.S. national security."6 Specifically, "long-term strategic competitions with China and Russia are the principal priorities."7 It goes on to elaborate that, "China is leveraging military modernization, influence operations, and predatory economics to coerce neighboring countries to reorder the Indo-Pacific region to their advantage."8 However, beyond the Indo-Pacific region, the People's Republic of China (PRC) is pursuing a course of expansion that threatens the key US defense objectives of:

1. "Sustaining Joint Force military advantages, both globally and in key regions"

2. "Maintaining favorable regional balances of power in the Indo-Pacific, Europe, the Middle East, and the Western Hemisphere," and

3. "Ensuring common domains remain open and free."9

The PRC potentially threatens these objectives via a program of infrastructure expansion it began in 2013.

3.3 Chinese Expansion:

The Belt and Road Initiative (BRI), originally referred to as the "One Belt, One Road Initiative," began in 2013 following an announcement by President Xi Jinping. The initiative consists of two distinct efforts: the Silk Road Economic Belt, and the Maritime Silk Road.10 According to President Xi Jinping, the BRI will "strengthen cooperation with countries along the land and maritime Silk Roads, so as to jointly build an open platform for cooperation and create new impetus to achieve sustainable development in the related regions."11 The Silk Road Economic Belt is primarily aimed at land-based infrastructure to facilitate international trade with China and globally expand Chinese economic influence throughout Asia, Europe, and Africa. A flagship example of this effort is the China-Pakistan Economic Corridor (CPEC). According to the Chairman of Chinese National Development and Reform Commission, Mr. He Lifeng, CPEC seeks to "improve the region's infrastructure, and put in place a secure and efficient network of land, sea and air passages, lifting their connectivity to a higher level; further enhance trade and investment facilitation, establish a network of free trade areas that meet high standards, maintain closer economic ties, and deepen political trust."12 Similar to this Economic Belt, as a complementary effort, the PRC is pursuing a global network of maritime ventures designed to achieve the same objective via "jointly building smooth, secure and efficient transport routes connecting major seaports along the Belt and Road."13 This expansion effort should not be confused with PRC expansion into the South China Sea via their "Nine Dash Line" proclamation, which is a different political movement, though one which is potentially an equal indicator of future intent.

Fundamental to the BRI's concept is President Xi Jinping's stance that "China will continue to pursue win-win cooperation and enhance friendship and cooperation with other countries."14 The concept of "win-win" relationships implies that both countries will achieve some sort of windfall at the completion of mutual endeavors. Therein lies the contentious interpretation of the BRI's purpose. While BRI may be portrayed as an economic "win-win," many skeptics believe the relationship to be coercive between China and the nations it supports through BRI investments. C4ADS summarizes this notion in a related analysis by stating "with over one-third of the BRI participant countries vulnerable to debt distress, unfavorable deals can put a country at an economic disadvantage, endowing China with outsized leverage over its partner."15 Though BRI is a state-sponsored program of expansion, the individual actors for the BRI are the network of Chinese companies conducting individual business deals with nations around the globe.

3.4 Understanding Chinese Corporate Players:

Unlike Western contemporaries, the majority of Chinese corporations are very closely tied to the Chinese State. To succeed, the BRI relies on Chinese corporations to operate in a semi-autonomous fashion to pursue ventures ultimately aimed at supporting the overall goals of the nation. Several Chinese companies have major roles in the BRI. Their roles will be described throughout the rest of this report, specifically: China Communications Construction Company (CCCC), China Harbor Engineering Company (CHEC), COSCO Shipping Holdings (COSCO), China Merchants Port Holdings (CMPort), China Overseas Port Holding Group (COPHC), and Landbridge Group.

CCCC was founded in 2006 as a state-run enterprise and claims to be "the largest port construction and design company in China, a leading company in road and bridge construction and design, a leading railway construction company, the largest dredging company in China and the second-largest dredging company (in terms of dredging capacity) in the world. [CCCC] is also the world's largest container crane manufacturer."16 Notably, CCCC played a significant role in the construction of the contentious Paracel and Spratly Island infrastructure.17 Via its subsidiary organizations, CCCC has played a major role in the development of several overseas locations of interest. COPHC, a subsidiary of CCCC, is the governing authority for the development of Pakistan's Gwadar Port,18 which is an integral part of CPEC. CHEC, also a subsidiary of CCCC, "has been developing and operating overseas business on behalf of CCCC [...] in over 80 countries throughout the world," and operates primarily in the "Engineering-Procurement-Construction (EPC), Build-Operate-Transfer (BOT), and Private-Public-Partnership (PPP)" sectors. In addition to land-based infrastructure, CHEC has construction roles in the development of the ports at El-Hamdania, Sokhna, Colombo, and Hambantota in Algeria, Egypt, and Sri Lanka respectively.19

CMPort, a subsidiary of the state-owned China Merchants Group,20 owns or operates portions of the ports of Colombo (Sri Lanka), Hambantota (Sri Lanka), Doraleh (Djibouti), and Kumport (Turkey).21 Perhaps more significantly, but beyond the scope of this analysis, in 2013 CMPort acquired a 49% operational stake in Terminal Link, a joint venture with the French firm CMA-CGM. According to the press release, "Terminal Link owns 15 container terminals in 8 countries across four major continents" to include: the Belgian ports at Zeebrugge and Antwerp, the French ports at Dunkirk, Le Havre, Montoir, and Fos, the Moroccan ports at Casablanca and Tangier, the American ports at Houston and Miami, the South Korean port at Busan, the Maltese port at Marsaxlokk, and the Ivorian port at Abidjan.22 Additionally, China Merchants Group, through its subsidiary, China Merchants Energy Shipping, and via their (China Merchants Energy Shipping) subsidiary CSC RoRo Logistics Ltd., "operates a fleet of 25 car carriers and large transshipment depots around the country."23 Finally, following a 2017 merger China Merchants Group acquired the subsidiary Sinotrans & CSC Co. Ltd. which specializes in logistics and freight shipping.24

COSCO is arguably the most wide-reaching of all Chinese maritime industries. COSCO Shipping Holdings is a state-run company which "is mainly engaged in domestic and international maritime container transport services and related businesses."25 According to COSCO, as of 2020 they, "owned and operated 536 container vessels with a total capacity of 3.1 million TEUs, ranking 3rd place in the world in terms of shipping capacity."26 In addition to container transportation, COSCO Shipping Specialized Carriers Co. Ltd. operates a fleet of special use vessels, to include multi-purpose, heavy lift, semi-submersible, and specialized car carriers.27 Besides this extensive capacity for shipping, COSCO also operates an extensive network of port facilities, with terminals in Seattle (USA), Chancay (Peru), Zeebrugge (Belgium), Antwerp (Belgium), Bilbao and Valencia (Spain), Vado (Italy), Piraeus (Greece), Kumport (Turkey), Abu Dhabi (UAE), Busan (Korea), and Singapore.28 In addition to being an extensive list of locations, the similarity of locations between CMPort ventures and COSCO terminals indicates possible cooperation amongst Chinese maritime companies.

While all these companies can be directly tied to the Chinese state, Landbridge Group, a privately owned company based in Rizhao, China, has also played a significant role in China's overseas expansion, although perhaps to a lesser extent than explicitly state-owned enterprises. That said, a 2015 photo documents Landbridge's founder, Ye Cheng, receiving a congratulatory handshake from Chinese President Xi Jinping following Landbridge's 2015 acquisition of a 99-year lease to operate Darwin Port in Australia,29 indicating a potential degree of government supervision or cooperation. Landbridge's main acquisitions, as mentioned, are the purchase of the port in Darwin, Australia30 as well as the purchase and ongoing development of the Panama Colon Container Port, at the Caribbean entrance to the Panama Canal.31 Although Landbridge Group is a privately owned company based in China, the relationship between Chinese corporations and the state is distinctly different compared to western norms.

3.5 Chinese Civil-Military Relationship:

China has long operated under the fundamental concept of Civil-Military Integration (CMI). CMI is "a process combining defense and civilian industrial bases to support military and commercial demands."31 Consequently, the corporate structure of Chinese business differs considerably from western societies. Specifically, where a western business must follow the rules of their government but, in most cases, is not strictly subservient to that government, Chinese businesses operate in a more controlled business sphere. In 2015, President Xi Jinping expanded on the concept of CMI, with a new concept, Military-Civil Fusion (MCF) when he stated:

"We should coordinate the development of our economy and defense capabilities, and combine efforts to make the country prosperous and military strong. We should further the great integration of military and civilian development, and work to achieve in-depth integration of the use of infrastructure and other key facilities based on demands and led by the government."33

According to the U.S. State Department, MCF is "an aggressive, national strategy of the Chinese Communist Party" whose goal "is to enable the PRC to develop the most technologically advanced military in the world."34 This is to be accomplished via the "elimination of barriers between China's civilian research and commercial sectors, and its military and defense industrial sectors."35 Though CMI and MCF are only concepts for operation between the Chinese state and the Chinese populace, government regulations and policy reflect the desired intent of both programs. Article 7 of the National Intelligence Law states, "Any organization or citizen shall support, assist and cooperate with the state intelligence work in accordance with the law" and "the State protects individuals and organizations that support, assist, and cooperate with national intelligence work."36

As a further measure to blur the lines between civilian and military operations, in 2016's National Defense Transportation Law, Chinese state authority was further expanded by placing "obligations on Chinese transportation enterprises located abroad or engaged in international shipping" to "provide logistical support for PLA forces operating overseas" as "strategic support forces."37 These support forces are charged with "rapid, long-distance, and large scale national defense support" and are typically composed of "large- and medium-sized Chinese companies."38 Finally, this law also "China's 2017 strengthened construction standards for ships and aircraft to be built to military specifications," in keeping with the dual-use concept.39 The result is the possibility that civil ships could be easily repurposed for military use at a moment's notice.

3.6 Cause for U.S. Concern:

The PRC's concept of using civilian commercial shipping to transport military supplies has been formally adopted via the formation of "transport dadui."40 Literally translated, "Dadui" means "military group." As mentioned earlier, and as an example, CMPort's indirect subsidiary, CSC RoRo Logistics Ltd. is the core of the "Fifth Transport Dadui," and has participated in eight transport missions with the People's Liberation Army (PLA), as well as a civil-military exercise in 2017.41 The concept of transporting military units has been promulgated via various Chinese public forums, as seen in several images below identified as part of a U.S. Naval War College report:

Such cooperation can also be seen in other forms of civil shipping. Sinotrans & CSC Co. Ltd, the subsidiary company of China Merchants Group, participated in underway replenishment (UNREP) activities with the Chinese Type 54A (Jiangkai II) frigate Linyi.44 The goal of this activity, according to the U.S. Naval Sea Systems Command is to enable ships to "remain underway at sea indefinitely in support of our national interests" by transferring "items such as fuel, food, ammunition, repair or replacement parts, and personnel."45 This cooperation could allow extensive PLAN operations beyond traditional territorial ranges through the cooperative use of civilian supply assets.

These instances of civil-military cooperation have become part of the basis for U.S. modeling of Chinese intentions. According to the U.S.-China Economic and Security Review Commission:

"China's basing model includes military facilities operated exclusively by the PLA as well as civilian ports operated or majority-owned by Chinese firms, which may become dual-use logistics facilities. Chinese firms partially own or operate nearly 100 ports globally, more than half of which involve a Chinese state-owned enterprise (SOE)."46

Based on this concept, the report also states:

"In the short term (next five years), the PLA will focus on consolidating the capabilities that would enable it to conduct large-scale military operations around its maritime periphery. In the medium term (next 10-15 years), the PLA aims to be capable of fighting a limited war overseas to protect its interests in countries participating in the Belt and Road Initiative (BRI). By mid-century, the PLA aims to be capable of rapidly deploying forces anywhere in the world."47

Following this same logic, and in accord with the previously stated Key Intelligence Question, this report has attempted to identify factors that threaten Critical Maritime Chokepoints within the scope of this question.. Relative to Chinese strategic imperatives of Food Security, Energy Security, and Trade Security, Chinese Belt and Road initiatives, specific to maritime expansion, have been identified and analyzed for their potential use as PRC dual-use stepping stones in a militarized environment, much like that described in the "Thucydides Trap."

4. Analysis Factors

4.1 Intelligence Question Amplification:

To reiterate, the Key Intelligence Question to be answered is:

In the event of a Great Power Conflict, what Chinese maritime investments and developments abroad potentially threaten U.S. and Allied naval capability use of critical maritime chokepoints?

After reviewing the strategic environment and the potential direction a Great Power Conflict (GPC) may take, the intricate relationship between Chinese Civil and Military ventures, and the extent of the BRI, this analysis investigates the potential for dual-use militarization of BRI infrastructure. With this specific direction in mind, the following additional intelligence questions have been created in order to fully answer and build upon the Key Intelligence Question:

- Where is China pursuing overseas maritime investment?

- To what extent are identified locations of Chinese investments being developed?

- What are the indicators associated with Chinese expansion plans and do they fall into a predictable timeline?

- What possible priorities do construction activities indicate?

- Has China deployed, or can it support the deployment of, threat weapons to these locations?

- What weapons could be supported at each location?

- What are the expected engagement envelopes of these weapons?

- How do these engagement envelopes affect maritime chokepoints?

- How would/could they be transported?

- How do these threats affect maritime chokepoints?

4.2 Assumptions and Disclaimers:

To completely answer these questions, a comprehensive analysis of the global situation would be ideal. However, the scope of this report is inherently limited based on manpower, resources, and time. For example, companies like CCCC have investments in over 80 countries, while commercially associated ventures like Terminal Link provide access to a multitude of global terminals for their parent companies. This analysis is further complicated by the sheer size of each company and the combined mass of international investments. Though possible to analyze each location, the time required and mass of information needed to accurately profile each individual point of interest would preclude the timely publication of this report. As such, several critical assumptions and concessions have been made that limit the conclusions of the report. First, this analysis focuses on a limited number, 17, of BRI locations of interest. Second, locations of interest have been selected based on their proximity to critical maritime chokepoints. Third, maritime strategic chokepoints have been limited to eight major waterways of global significance. As a consequence of these factors, and the underlying limitation of scope, the results of this report are a generalization of observed trends and cannot be definitely applied to the entire global spectrum of BRI activities. However, the conclusions made indicate the assessed possibility of certain actions and capabilities. Though there are doubtless many more locations of interest that are relevant to this discussion, and there are more maritime chokepoints of lesser significance, the selection of Chinese-built maritime facilities, whether completed or under construction, illustrates the concepts, themes, and application of GEOINT methods using limited resources to derive evidence-based analytic conclusions and possibilities.

4.3 The Importance of Maritime Chokepoints:

While commercial factors are a significant component of any maritime chokepoint discussion, this report will focus on the potential restriction of movement imposed upon military maritime movements by potential PRC dual-use infrastructure. Academically, "a chokepoint, in a strategic sense, should be a relatively narrow waterway, capable of being closed off to shipping."48 Consequently, this means there are "no readily available alternative maritime route[s] to use in event of closure" or "an alternative waterway would be extremely costly."49 Additionally, a critical chokepoint must be "of considerable significance to interests of several States, other than the State or States controlling the waterway."50 Alexander describes the military significance of chokepoints by tying them to the need for, "the passage of military vessels and aircraft through narrow international waterways anywhere in the world."51 In the case of the United States, where for the last 30 years the preponderance of operations has focused on the Middle East, bringing logistical support and warfighting capability to bear has required the security of these chokepoints. In a Great Power Conflict, it is reasonable to assume that chokepoints will be of similar importance.

4.4 Identifying Critical Maritime Chokepoints:

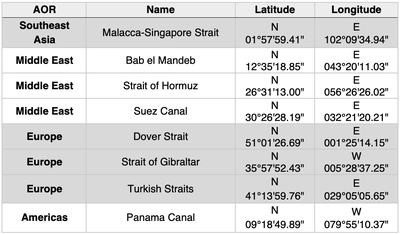

In his article, Alexander identifies seven "primary chokepoints": The Strait of Gibraltar, the Bab el Mandeb, the Strait of Hormuz, the Danish Straits, the Turkish Straits, the Suez Canal, and the Panama Canal.52 All these meet the three earlier criteria of being narrow, having no alternative route, and being significant to multiple nations. Additionally, Alexander lists eleven "secondary chokepoints" which include the Malacca-Singapore Strait and the Dover Strait, among others.53 For the purposes of this report, the Danish Straits will be omitted due to its limited role in a Great Power Conflict with China, though their significance in a similar conflict with Russia should not be discounted. Therefore, based on these lists, and for the purposes of the ensuing analysis, the following chokepoints are considered Critical Maritime Chokepoints (CMC) and have been grouped into one of four Areas of Responsibility (AOR): Southeast Asia, Middle East, Europe, and Americas:

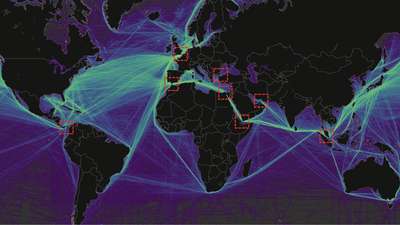

To illustrate the significance of the chosen CMC, their locations have been superimposed on a National Oceanographic and Atmospheric Administration layer which compiled a generalized heat map of shipping traffic.

Visually, the selected maritime checkpoints intersect a significant portion of maritime shipping routes. Though there are alternatives that bypass the identified checkpoints, such as around the Cape of Good Hope, they incur significant costs to operations.

4.5 Locations of Interest:

Based on the identified CMC, locations of interest (LOI) can be identified to answer the first intelligence question: Where is China pursuing overseas maritime investment? By using open source reporting from news agencies, social media outlets, and PRC proprietary media marketing, a preliminary investigation of BRI ventures in close proximity to the identified CMC has yielded 17 LOI. These 17 LOI have been similarly grouped into one of the four AOR.

4.6 Methods:

Analysis of the LOI has been conducted using Maxar commercial imagery provided via the Google Earth platform. At each location of interest, subsequent analysis has searched for indicators of maritime expansion. Drawing from the earlier discussion of BRI, a notable indicator of Chinese infrastructure development is the presence of extensive land reclamation projects, as this is a key component of known expansion efforts in the South China Sea conducted by CCCC. Since land reclamation (if necessary) is a frequent first step in the typical port construction, it serves as a sound indicator for temporal analysis and building patterns of life. Where possible, an assessment of construction progress has been made to determine the expected progression of development. Additionally, an assessment of local room for potential expansion has been made where applicable. Specific emphasis has also been placed on identifying commercial and military shipping capabilities. Hosted vessels (military and commercial) will be identified to baseline the future capability to host threats enabled by those vessels. Based on the discussion of the PRC's civil-military relationship, the analysis has attempted to identify three specific types of operations capability: Military vessel, Roll-On Roll-Off (RO-RO) vessel, and Container vessel.

This report will assess capability based on the observation of historical precedents for operations of certain types of vessels. This will be particularly important regarding Chinese military vessels. In an effort to derive more concrete conclusions, rather than induce speculation, assessment of naval vessel hosting capability will be established by 1) imagery confirmation of existing operations or 2) open source reporting of existing operations. In some cases, this may lead to assessments where smaller or less sophisticated facilities are deemed capable of hosting naval vessels while larger facilities are not. Moreover, such a deliberate methodology will provide a reliable assessment of current operations. Conversely, while a concrete assessment may not be possible at a larger facility due to the criteria above, the reader might infer the physical capability for naval hosting at a location capable of managing, for example, commercial supertankers. There are many variables that can induce limitations to which type of vessel a port can host, such as draft, fuel available, pilotage, etc. In an effort to limit scope, this report will not address niche aspects of port infrastructure as they pertain to vessel types, except where particularly relevant. Ream Naval Base provides an example of this precedent in discussing draft (5.1.1). Furthermore, while the premise of placing threat weapons on foreign territories is aggressive and confrontational, it can be accomplished with a degree of anonymity and done covertly. Doing so might not arouse concern or suspicion until after the fact. In contrast, the movement of military vessels is rarely covert. The movement of a military vessel into a foreign port, as in this hypothetical what-if scenario, would require some form of plausible explanation, pattern of life, or reasonable expectation of normalcy. That said, changing political environments and international relationships can rapidly change these assessments based on the willingness of other nations to cooperate with China, a variable that further reinforces the need for diplomatic engagement as part of the strategic environment.

4.7 Open Source Threats:

Disclaimer: All threat ranges are estimated via open source reporting and should not be considered authoritative, merely representative of threat potentials.

To fully understand the implications of the Chinese capability to limit U.S. and Allied naval mobility via strategic chokepoints threats must be identified. To deny naval movement, which for the purposes of this report will only encompass surface vessels and their associated airborne assets, the PRC may utilize various anti-ship and anti-aircraft weaponry. Anti-Ship weapons will be limited to Anti-Ship Cruise Missiles (ASCM) and Anti-Ship Ballistic Missiles (ASBM). Anti-Aircraft weaponry will be limited to Surface-to-Air-Missiles (SAM).

As this report seeks to identify only those threats which can rapidly be deployed to port facilities, threats will be limited to three general categories: mobile, naval, and containerized. This report defines mobile threats as wheeled or tracked vehicles capable of being transported by military or Roll-On Roll-Off vehicles. Naval threats are defined as combatant vessels with their associated weaponry. Finally, containerized threats are defined as concealable weapons within shipping containers. These specific weapon types are included because they may be overtly transported via military vessel or covertly transported via dual-purpose vessels that form the transport dadui mentioned earlier.

Mobile threats include the DF-21D ASBM, YJ-18 ASCM, YJ-12 ASCM, SA-21, SA-10, and HQ-9. The DF-21D, YJ-18, and YJ-12 possess anti-ship capability with ranges of 800nm,55 290nm,56 and 270nm,57 respectively. For anti-aircraft systems, the SA-21,58 in its latest evolution, will be assessed with 250nm engagement zone, and SA-1059 will be modeled with a 120nm engagement zone.

Naval threats are based on the weaponry standard on the Chinese Type 52D destroyer (Luyang III), the most sophisticated surface combatant noted, to date, at the PLA Expeditionary facility in Djibouti.60 The Type 54D is equipped with the HHQ-9 and HHQ-10 SAM, and the YJ-18 ASCM,61 with approximate ranges of 52nm, 9nm, and 290nm,62 respectively.

Containerized threats include only the YJ-18C, which is a reported cruise missile variant capable of being operated from commercial shipping containers, with a range of 290nm.63 Though reporting is limited, reporting and rumors of both Russian and Chinese capability to field missile systems located in shipping containers should not be discounted. Russian systems of this type, based on the 3M54 family of cruise missiles, such as the Klub-K have been reported.64 Based on the history of Russian and Chinese arms cooperation, and the covert intent of these threats, being highly transportable and simultaneously very anonymous, the inclusion of such threats is based on potential intent and logical direction.

5. Analysis

5.1 Southeast Asia:

5.1.1 Ream Naval Base:

Ream Naval Base is a Cambodian Military facility located in Sihanoukville, Cambodia. It is wholly-owned and operated by the Cambodian Government, with the nearby town of Sihanoukville the site of a deep-water port, currently under development in partnership with the Japanese government. Ream itself has been the site of recent controversy as speculation circulated that China had recently formalized a 30-year use agreement for the base,65 despite historic U.S. investment and involvement at the facility66 and denial of the agreement by the Cambodian government.67 Imagery analysis of Ream shows no specific Chinese activity or infrastructure investment. Though a naval facility, the placement of floating dry docks in the nearby channel, as well as the placement of a POL pier to the south, indicate the coastal waters are of insufficient depth for major surface vessels. As such it is assessed that Ream Naval Base will be incapable of hosting major shipping or warships pierside unless significant dredging and infrastructure modification is undertaken, and basing is limited to the observed coastal patrol craft. This does not preclude the use of deeper waters as a safe harbor for larger vessels, of which none have been observed to date. However, the shallow waters do significantly complicate the logistics of disembarking possible mobile threats. As such, the current assessment of Ream Naval Base is one of minimal hosting capability, with no observed capability for naval, mobile, or containerized threats. Subsequent monitoring should be conducted with emphasis on identifying indicators of potential PRC development and PLAN use.

5.1.2 Melaka Gateway Port Project:

The Melaka Gateway Port Project began as a joint venture between the Malaysian government and a Chinese conglomerate comprising PowerChina International Group, Shenzhen Yantian Port Group, and Rizhao Port Group.68 Rizhao Port Group, notably, also operates Shandong province's Rizhao Port at which Landbridge Group maintains its corporate headquarters and operates multiple terminals.69 The project is of particular significance due to its location at the narrowest part of the Malacca-Singapore Strait which "makes it an ideal choice for a deep seaport facility" due to "the strategic location [...] at the Straits of Malacca."70 Consequently, development of this location could significantly restrict any ability to transit the Strait.

Initial land reclamation of the facility has been undertaken by the Malaysian KAJ Development however, imagery analysis of the effort corroborates reporting that KAJ has since lost the contract for development due to slow progress. This is indicated by the removal of construction support facilities, characterized by signature blue roofs, and dredging equipment. While the intricacies of the contractual arrangements for the facility can be generally characterized as unstable, the persistent presence of Chinese investors leaves reason for continued monitoring of the facility. Based on these factors, the current assessment of the Melaka Gateway Port Project is one of no hosting capabilities, with no observed capability for naval, mobile, or containerized threats. Subsequent monitoring should be conducted with emphasis on detecting the re-introduction of construction buildings, which will indicate renewed efforts at land reclamation and should prompt changes in collection requirements.

5.1.3 Port of Kuantan:

The Port of Kuantan is a flagship BRI investment located on the eastern side of the Malaysian Peninsula. Kuantan is a joint venture between the Malaysian firm IJM and the Chinese Beibu Gulf Port Holding (Hong Kong) Co. Ltd, which maintains a 40% share.71 Beibu Gulf Port Holding (Hong Kong) acts as a wholly-owned subsidiary of the Chinese SOE72 Guangxi Beibu Gulf International73 thus implying state interest in the port facilities.

Imagery analysis of the port indicates completion of the planned phase 1A and 1B of modernization, which began in 2013 immediately following the launch of the BRI campaign and was approximately completed in January 2019. The continued presence of construction support facilities, noted by their blue roofs, and of unfinished land reclamation indicates construction is likely to continue. According to the Kuantan Port website, a second larger container terminal will be constructed, with undetermined "future plans."74 Based on patterns of life from phase 1 construction, this phase will likely require three to four years to complete. The newly constructed unused pier infrastructure retains the capability to be used for vehicle off-loading based on pier construction. PLAN warship support has not been observed. Immediately to the south, the Malaysian Tanjung Gelang Naval Base indicates some limited capability for warship hosting, though this would require cooperation with the Malaysian government and may also serve as a limited deterrent to Chinese warship presence. Based on these factors, the current assessment of the Port Kuantan is one of moderate hosting capabilities, with no observed capability for naval threats but with the emerging capability to host mobile or containerized threats. Subsequent monitoring should be conducted with emphasis on monitoring phase two construction and maritime traffic at newly constructed port facilities.

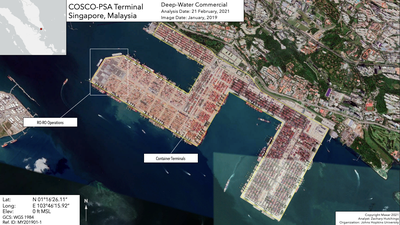

5.1.4 Port of Singapore:

The Port of Singapore is a strategically significant location for future Chinese investment based on its location at the junction of the South China Sea and the Indian Ocean via the Strait of Malacca. COSCO recently, in November of 2018, announced modification of its arrangement with PSA Co. Ltd. (formerly Port of Singapore Authority) which expanded COSCO port access from three wharfs to five. To reinforce the magnitude of the COSCO investment in Singapore, Mr. Ong Kim Pong, the Regional CEO for PSA International's Southeast Asia division75 stated, "PSA is honored by the trust that CSP has placed in us to serve as their main hub port for container transshipment in Southeast Asia. With their continued support and confidence in PSA, we will strive to augment their strategic presence in Singapore."76 This reinforces the probability that Chinese investment in the Port of Singapore will continue to expand and is of strategic value. The port itself has the observed capability to conduct Roll-On Roll-Off and Container shipping operations. Based on these factors, the current assessment of the Port of Singapore is one of moderate hosting capabilities, with no observed capability for naval threats but with the capability to host mobile or containerized threats. Subsequent monitoring should be conducted with emphasis on monitoring COSCO shipping traffic and cargo manifests to establish a pattern of life.

5.1.5 Port of Kyaukphyu:

The Port of Kyaukphyu, Myanmar, is a flagship port project as part of the Belt and Road Initiative, and more specifically the China-Myanmar Economic Corridor. The overt intent of this project is to facilitate Chinese Maritime economic interests through overland means terminating with the Port of Kyaukphyu as a means of dealing with the "Malacca Dilemma."77 The "Malacca Dilemma" is the concept that the Strait of Malacca provides a limitation for Chinese economic activities to escape the South China Sea region if contested by another state.78 The acknowledgment of such a situation indicates the PRC's greater understanding of the significance of maritime chokepoints in the strategic sense. As such, the PRC has begun a process of development with the government of Myanmar via a Chinese SOE known as CITIC.79 As part of the development plans, Kyaukphyu is intended to operate a "total of 10 berths, [...] constructed in 4 phases, with construction duration of 20 years," and "the expected annual capacity of the DSP will be 7.8 million tons of bulk cargo and 4.9 million TEU containers."80 Currently, the only operations in the immediate vicinity are via a petroleum facility to the east of the proposed construction location. Based on these factors, the current assessment of the Port of Kyaukphyu is one of no hosting capabilities for naval, mobile, or containerized threats. However, based on imminent construction, monitoring should be conducted to assess construction progress and initial operating capability, which may then be used to trigger more robust collection efforts.

5.1.6 Port of Colombo:

The Port of Colombo, located on the western coast of Sri Lanka, has seen extensive PRC-related activity. A subsidiary of CMPort, CITC, which conducts construction at Colombo as part of a BOT agreement, operates the newly built facility as a PPP.81 Nearby, CHEC is constructing the Colombo Port City as a complimentary BRI effort to serve as "a catalyst for modern services in Sri Lanka."82 This indicates continued Chinese interest in the port for the foreseeable future. The east terminal, while operated by SLPA (Sri Lanka Port Authority) and not CITC, has hosted Roll-On Roll-Off vessels and a multitude of warships from several nations such as the U.S., Russia, and Japan. While not indicative of Chinese intent, it suggests the port is capable of hosting such vessels, if required or desired. To reinforce this capability, according to open source reporting,83 in 2014 several Chinese warships docked at Colombo. This event, coupled with a denied request for port visits in 2017,84 potentially indicates Chinese desire and capability to use the port to support military vessels. Based on these factors, the current assessment of the Port of Colombo is one of robust hosting capability of naval, mobile, and containerized threats. Subsequent collection should be conducted to monitor Chinese construction, which will continue for several years, and shipping activity, with identification of all military vessels entering the port.

5.1.7 Port of Hambantota:

Also located on the island of Sri Lanka is the Port of Hambantota. Hambantota is currently owned and operated by CMPort, which controls 85% of port shares, as part of a 99-year lease agreement with the Sri Lankan government.85 As a major Chinese project predating BRI, Hambantota provides a template for project proceedings. Imagery indicates construction on the port began in 2010 and was completed in 2018, providing an approximate baseline for the timeline. The identification of buildings associated with construction and their relative erection/demolition provides construction signatures that can be extended to other infrastructure projects. However, this timeline is limited by the temporal coverage of Google Earth imagery revisits, which preclude the ability to precisely determine start and stop dates, and only provide sufficient detail for approximation. Port operations include container operations and Roll-On Roll-Off vessels. While no naval vessels have been noted, as with Colombo, PLAN port visits and attempts to make port suggest PRC military interest in the country. Additionally, by referencing Image 3.1, from chapter 3, it is apparent that although Hambantota does not directly influence any CMCs, it lies along a major corridor between the Southeast Asia and Middle East regions, which makes it strategically relevant to the maritime environment. Based on these factors, the current assessment of the Port of Hambantota is possibly capable of hosting naval, mobile, and containerized threats. Subsequent collection should be conducted to monitor port operations, commercial shipping activity, and PLAN vessel activity.

5.2 Middle East:

5.2.1 Port of Khalifa:

The Port of Khalifa, located in Abu Dhabi is the site of a COSCO-operated terminal, which was constructed between 2017 and 2018.86 The facility is part of a 35-year agreement to operate the terminal as part of China's BRI expansion.87 Imagery indicates the port facility is capable of container operations and Roll-On Roll-Off operations. Based on these factors, the current assessment is the Port of Khalifa has the capability to host mobile and containerized threats. Subsequent collection should be conducted to monitor port operations and commercial shipping activity to establish a pattern of life.

5.2.2 PLA Expeditionary Base:

Perhaps the most significant overseas investment, though not wholly part of BRI, is the development of a PLA Expeditionary Base in Djibouti. Located roughly 10km from a U.S. military facility, the PRC has developed the base in close concert with its port expansions as part of BRI. Doraleh Multipurpose Port was constructed by CCCC and is currently operated by CMPort, which retains a 25-percent stake of ownership.88 Construction at the base began in 2014 and is still developing, with continued dredging operations ongoing in support of deep-water berthing, as well as various building construction projects. The base facilities indicate the ability to support aircraft, via the heliport tarmac, with hardened structures that could potentially be used for munitions storage. Via the use of Doraleh, which imagery shows had been used for PLAN berthing previously, the base could support significant quantities of troops and vehicles, with Roll-On Roll-Off capabilities also confirmed. The use of a PRC-controlled (via SOE) civilian port to support military vessels provides additional reinforcement to the concept of civil-military cooperation as part of China's BRI infrastructure development. Based on these factors, the current assessment of the PLA base in Djibouti is: significant hosting of naval, mobile, and containerized threats is possible and likely. Subsequent collection should be conducted to monitor unit deployments and identify specific threats.

5.2.3 Port of Sokhna:

The Port of Sokhna is arguably one of the more benign and lower-profile investments of the BRI. The port itself is owned and operated by DP World, an Emirati shipping conglomerate based in Dubai. However, in 2018, DP World began construction on a second basin of Sokhna, which was contracted to CHEC.89 The project is nearing completion, with final infrastructure being put in place. Though this was initially only a construction agreement, DP World began a partnership with a COSCO and CSCEC (China State Construction Engineering Corporation) to utilize the newly constructed basin as the primary port for material deliveries destined for other inland BRI projects in the region.90 This has resulted in an expected expansion of PRC shipping operations at the yet unused second basin. Based on these factors, it is assessed that the Port of Sokhna will expand its operations and is capable of hosting containerized threats. Given the lack of operations, it is not possible to determine the extent of mobile or naval threat hosting at this time. Subsequent collection should be conducted to monitor shipping presence and operations details at the second basin location with the intent of developing greater fidelity of threat capabilities.

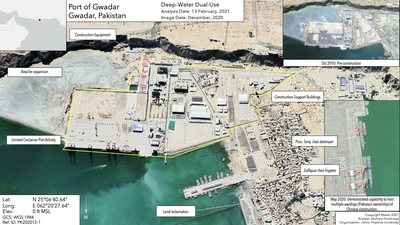

5.2.4 Port of Gwadar:

The Port of Gwadar is a flagship BRI project. As a function of its location, it is a critical node of the CPEC and also a significant strategic outpost for maritime shipping transiting to/from the Persian Gulf. The port itself is operated by COPHC, the CCCC subsidiary, and has been actively developed since 2013 as part of an extensive BRI plan. This includes the construction of several highways, secondary piers, industrial zones, and an international airport.91 Consequently, the location has seen significant development to date, both within and without the fence line of the existing port. Notably, the existing multipurpose port, despite being touted as a significant component of BRI, has experienced limited commercial activity to date. Equally notable, several Pakistani Naval vessels have been observed at the port, identified as Zulfiquar class frigates and Tariq class destroyers. The port's ability to host such vessels is significant because the Zulfiquar class is an export variant of the Chinese Type 53H3 (Jiangwei) frigates.92 This implies the ability to support Chinese warship requirements, both in draft and logistical requirements. Additionally, the Pakistani Navy has purchased further naval vessels from China: four Type 54A/P frigates, a variant of the Jiangkai 2 class.93 As mentioned earlier, Chinese commercial ships have engaged in underway replenishment of Jiangkai 2 frigates. Thus, the port's ability to host Pakistani warships may indicate a willingness, or at least capability, to host Chinese warships of similar construction. Based on these factors, it is assessed that the Port of Gwadar will expand its operations and is capable of hosting naval, mobile, and containerized threats. Given the lack of operations, it is not possible to determine the extent of mobile or naval threat hosting at this time. Subsequent collection should be conducted to monitor operations, expansion efforts, and warship presence.

5.3 Europe:

5.3.1 El-Hamdania Port Project:

El-Hamdania is a significant BRI investment, though at this time very little progress has been made. Construction began in late 2017/early 2018 and to date has yielded very few results with the conclusion being the project has stalled as of 2019.94 The Memorandum of Understanding for the project entails construction requirements by CSCEC and CHEC with port operations to be retained by a yet undetermined Chinese firm for the first 25 years, post construction.95 It is expected Chinese companies will retain a 49% stake in the port.96 This is of particular significance because the militarization of El-Hamdania could pose a significant threat to the Strait of Gibraltar. While the agreement is commercial, the relationship between China and Algeria is one of increasing PRC leverage. Specifically, Algeria is the PRC's largest trading partner in Africa, with a very lopsided balance of trade.97 Additionally, the proportion of trade made up of Chinese weaponry is reported to be "42% of exports to the continent."98 There have also been documented reports of Chinese naval vessels visiting the Algerian port of Algiers.99 Based on these factors, it is assessed that the El-Hamdania Port Project may expand its operations and will be eventually capable of hosting naval, mobile, and containerized threats. However, given the lack of development, it currently retains no threat hosting capability. Subsequent collection should be conducted to monitor construction and potential operations.

5.3.2 Port of Zeebrugge:

The Port of Zeebrugge is strategically located on the mainland European side of the English Channel. Consequently, the purchase of roughly 76% of the former APM terminal, gives COSCO shipping a controlling interest at a major intersection of sea lanes.100 The rebranded CSP Zeebrugge Terminal "is the first terminal in Northwest Europe in which the Company holds a controlling stake and will facilitate the Company in establishing its major hub ports and global strategic focal point."101 Based on imagery analysis, current operations at the terminal are strictly limited to container shipping. While the port does provide roll-on roll-off services, these serve mostly to carry traffic across the Channel via ferries. Roll-On Roll-Off car carriers are observed at the port but serve proprietary piers further inland and are thus not depicted. Of note, the CSP terminal is in close proximity to a Belgian Naval Base and thus could fulfill additional militarized requirements such as intelligence collection and non-kinetic application of effects, such as communications jamming. Based on these factors, it is assessed that the CSP Zeebrugge terminal is capable of only containerized threats. However, the proximity to a NATO facility may facilitate the use of the port for covert activities. Subsequent collection should be conducted to monitor operation.

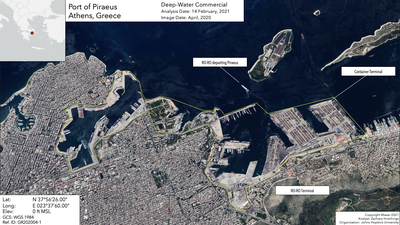

5.3.3 Port of Piraeus:

The Port of Piraeus is one of the more dramatic acquisitions the PRC has facilitated as part of BRI. While not an infrastructure project in and of itself, following the recession Greece encountered at the start of the 21st century, COSCO, via subsidiaries, has operated a container terminal since 2008.102 However, in 2016, COSCO acquired a controlling 51% share of the Piraeus Port Authority, which manages the entire port, with a follow-on condition that another 16% be transferred in 2021 subject to investment goals being met.103 Operationally, the port sees container and Roll-On Roll-Off operations regularly. Though the port is capable of hosting PLAN vessels, and has done so, the proximity to the Hellenic Naval Base at Salamis, approximately 3.5km to the east, makes the tactical feasibility of such hosting unlikely. However, much like Zeebrugge, this opens the door to facilitate non-kinetic and covert operations at Piraeus. Based on these factors, it is assessed that the Port of Piraeus is capable of hosting mobile and containerized threats, with naval threats unlikely. Subsequent collection should be conducted to monitor operations and cargo loading/unloading.

5.3.4 Port of Valencia

Similar to the Port of Piraeus, the Port of Valencia is controlled by COSCO. COSCO's purchase of the related port authority, Noatum Port Holdings, of which it owns a 51% stake, gave the shipping company control of the Port of Valencia and Port of Bilbao container terminals.104 Consequently, this gives COSCO control of "the closest commercial port to the Suez-Gibraltar axis - the main route for interoceanic shipping lines."105 The Port of Valencia has hosted both container vessels and Roll-On Roll-Off vessels, though since the purchase by COSCO most RO-RO operations have ceased. Though some minor construction activities have been observed, it is unlikely significant construction will take place in the immediate future. Additionally, no naval vessels have been observed. Based on these factors, it is assessed that the Port of Valencia is capable of hosting mobile and containerized threats. Subsequent collection should be conducted to monitor operations, with emphasis on recognizing the resumption of RO-RO operations.

5.3.5 Port of Kumport:

The Kumport Terminal, in Ambarli Turkey, is of particular significance to the Turkish Straits and holds a controlling position in the Sea of Marmara, at the southern mouth of the Bosphorus. While not as significant as other maritime chokepoints, this location enables complete control of shipping to and from many several European Countries. The port itself was purchased by a "Tripartite Consortium" comprised of CMPort, COSCO, and CIC Capital, which control 65% of Kumport via a 40/40/20 split.106 Of note, CIC Capital is a PRC SOE, as are COSCO and CMPort.107 Imagery indicates the port focuses primarily on container shipping, with a distinct lack of indicators typical of RO-RO operations. No military vessels are apparent at the facility, and given the restricted nature of the Dardanelles, the tactical risk involved in placing combatant vessels at Kumport is a significant factor. Based on these factors, it is assessed that the Port of Kumport is capable of hosting containerized threats only. Subsequent collections should be conducted to monitor operations to establish a pattern of life.

5.4 Americas:

5.4.1 Panama Colon Port Project:

The Panama Colon Port Project is a joint venture acquired by Landbridge Group in 2016 and developed by Shanghai Gorgeous investment Development Group.108 The project is of particular significance due to its controlling location at the Caribbean entrance to the Panama Canal, visible in the image above yards from the acquired property. Such a location poses a credible threat to U.S. access to the Panama Canal, not only due to the hypothetical placement of weapons systems on a dual-use facility, but also via more simple means such as basic channel blockage from deliberately placed obstacles in the event of a conflict. Additionally, this location is significant because the activity observed here confirmed earlier imagery analysis that identified a construction signature. The established pattern, that construction support facilities can be typically identified via blue roof signatures, has been reinforced by open source collection from the company website at this facility that supports this identification.109

According to various project publications, Shanghai Gorgeous intends to develop an extensive container terminal, and imagery analysis indicates significant progress to that extent has been made. However, since January 2020 no construction progress has been made, and construction equipment (barges and cranes) have been removed, while construction support buildings have degraded significantly and rapidly. Such indicators suggest that construction has stalled for some reason. One possible explanation may be workforce difficulties caused by the COVID-19 pandemic, while another may be contractual or funding difficulties. Based on these factors, the current assessment of the Panama Colon Container Port is one of no hosting capabilities, with no observed capability for naval, mobile, or containerized threats. Subsequent monitoring should be conducted with emphasis on monitoring construction status, as indicated by maintenance on support facilities or the return of construction equipment.

6. Application of Analysis

6.1 Assessment of Key Intelligence Question:

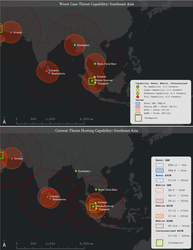

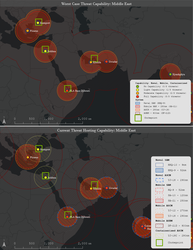

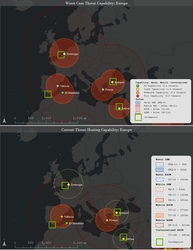

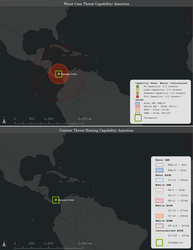

By applying the analysis of each port, as well as the assessment of threat capabilities listed above, and through the use of readily available GIS techniques, this report has created two assessments. First, a hypothetical worst-case projection of PRC threat capabilities for each BRI location has been developed to depict the potential threat each location poses to the U.S. and its allies if not properly managed through diplomatic, military, and economic channels. Second, an assessment of the current hosting capability of each location has been developed that matches current observed capabilities with the current threat estimate.

In Southeast Asia, current port infrastructure supports the ability to disrupt shipping in the Indian Ocean, the approaches to the Strait of Malacca, the South China Sea, and even the Sunda Strait. While development is limited at Ream, Kyaukphyu, and Melaka, there is still redundant coverage of critical chokepoints.

In the Middle East, current port infrastructure supports the ability to disrupt shipping in the Persian Gulf, the Red Sea, the Eastern Mediterranean, and preclude transit via the Strait of Hormuz, Bab el-Mandeb, Suez Canal, and Bosphorus. While development is limited at Sokhna and Kumport, even limited coverage poses a threat to such restricted waterways.

In Europe, current port infrastructure supports the ability to disrupt shipping in the Dover Strait/English Channel and the Strait of Gibraltar. Development is limited at Zeebrugge and non-existent at El-Hamdania, however, given the compressed nature of European sea routes, the single developed port of Valencia could affect the majority of the geographic region.

In the Americas, the current port infrastructure does not support the ability to disrupt shipping. However, given the holdings in the region, as little as two to three years of development at the Panama Colon terminal could disrupt the most important maritime chokepoints in the western hemisphere.

These graphics convey the current tactical significance Chinese covert prepositioning of threat weapons at dual-use facilities and assets would have on critical maritime chokepoints. It is currently assessed that the pre-placement of threat capabilities at the identified Belt and Road Initiative-related maritime infrastructures would enable the PRC to deny freedom of navigation to U.S and Allied maritime activities via all of the identified critical maritime chokepoints, with the exception of the Panama Canal.

It is important to note, however, that this conclusion implies the possibility that China could use civilian facilities for military purposes based on observed capability. It does not suggest that China has, or indeed will capitalize on this position or opportunity. Though a capability might exist, there is a multitude of factors that may influence national ability and desire to exercise such capability. In this particular instance, exercising the capability to place offensive weapons on the sovereign soil of a European state, would trigger immediate diplomatic and military backlash if done without host nation cooperation. Indeed, such action could logically be seen as the opening acts of a global conflict. As such, though there may be the ability to place threat missiles, there may be no desire. Evaluation of Chinese national strategic intent, internally navigating all the sovereign territorial hypotheticals and permutations of weapons placement beyond economic port support, is beyond the scope of this report. Consequently, this report recognizes the limitations of the aforementioned conclusion. It applies only to a situation in which China might seek to actively conduct aggressive military actions with little regard for international opinion or ensuing conflict, which would imply the failure of multiple levels of geopolitical driving factors such as diplomacy, global economics, military alliances, and a changing of the global status quo.

7. Glossary

ASBM: Anti-Ship Ballistic Missile

ASCM: Anti-Ship Cruise Missile

AOR: Areas of Responsibility

BOT: Build Operate Transfer

BRI: Belt and Road Initiative

CCCC: China Communications Construction Company

CHEC: China Harbor Engineering Company

CIC Capital: China Investment Corporation Capital

CMC: Critical Maritime Chokepoints

CMI: Civil-Military Integration

CMPort: China Merchants Port Holdings

COPHC: China Overseas Port Holding Group

COSCO: China Overseas Shipping Corporation

CPEC: China-Pakistan Economic Corridor

CSC: China Shipping Company

CSCEC: China State Construction Engineering Corporation

DOD: Department of Defense

EPC: Engineering Procurement Transfer

GEOINT: Geospatial Intelligence

GPC: Great Power Conflict

LOI: Locations of Interest

MCF: Military-Civil Fusion

NTM: National Technical Means

PLA: People's Liberation Army

PLAN: People's Liberation Army Navy

PPP: Private Public Partnership

PRC: People's Republic of China

PSA: Port of Singapore Authority Co. Ltd.

RO-RO: Roll-On Roll-Off

SOE: State-Owned Enterprise

SAM: Surface to Air Missile

UNREP: Underway Replenishment

8. Footnotes

1. Clark, Bruce. 2020. "The Thucydides Trap." The World Today. January. Accessed March 2021. https://www.chathamhouse.org/sites/default/files/field/field_document/16%20Thucydides%2005.pdf.

2. Ibid, 40.

3. Ibid, 40.

4. Jinping, Xi. 2015. Speech by H.E. Xi Jinping President of the People's Republic of China at the Welcoming Dinner Hosted by Local Governments and Friendly Organizations in the United States. September 22. Accessed March 7, 2021. https://www.fmprc.gov.cn/mfa_eng/topics_665678/xjpdmgjxgsfwbcxlhgcl70znxlfh/t1305429.shtml.shtml.

5. U.S. Department of Defense. 2020. "Military and Security Developments Involving the People's Republic of China: Annual Report to Congress." U.S. Department of Defense. Accessed March 7, 2021. https://media.defense.gov/2020/Sep/01/2002488689/-1/-1/1/2020-DOD-CHINA-MILITARY-POWER-REPORT-FINAL.PDF, 5.

6. US Department of Defense. 2018. "2018 National Defense Strategy Summary." US Department of Defense. Accessed March 6, 2021. https://dod.defense.gov/Portals/1/Documents/pubs/2018-National-Defense-Strategy-Summary.pdf, 1.

7. Ibid.

8. Ibid, 2.

9. Ibid, 4.

10. Chatzky, Andrew, and James McBride. 2020. China's Massive Belt and Road Initiative Backgrounder. January 28. Accessed March 6, 2021. https://www.cfr.org/backgrounder/chinas-massive-belt-and-road-initiative. 2020.

11. China-Pakistan Economic Corridor. Accessed March 6, 2021. http://cpec.gov.pk/.

12. Ibid.

13. Ibid.

14. Ibid.

15. Thorne, Devin, and Ben Spevack. 2018. "Harbored Ambitions: How China's Port Investments are Strategically Reshaping the Indo-Pacific." C4ADS Reports. April 17. Accessed February 5, 2021. https://c4ads.org/reports. 2008.

16. China Communications Construction Company Ltd. Accessed March 6, 2021. http://en.ccccltd.cn/aboutcompany/introduction/. 2020. "China's Construction Companies Sow Chaos Worldwide."

17. US Embassy in Georgia. Accessed March 7, 2021. https://ge.usembassy.gov/chinas-construction-companies-sow-chaos-worldwide/. 2015.

18. China Overseas Ports Holding Company Pakistan Ltd. Accessed February 20, 2021. http://cophcgwadar.com/about.aspx. 2020.

19. China Harbor Engineering Corporation. Accessed March 3, 2021. http://www.cccme.org.cn/. 2021.

20. China Merchants Group. Accessed March 3, 2021. https://www.cmhk.com/main/a/2016/a26/a30448_30530.shtml. 2020.

21. China Merchants Ports Holdings Ltd. Accessed March 3, 2021. http://www.cmport.com.hk/EN/business/Haiwai.aspx.

22. CMA-CGM. 2013. "CMHI and CMA CGM complete the Terminal Link Transaction." The CMA-CGM Group. June 11. Accessed March 1, 2021. https://www.cma-cgm.com/static/News/Attachments/CMHI%20and%20CMA%20CGM%20complete%20the%20Terminal%20Link%20transaction.pdf.

23. Kennedy, Conor M., "China Maritime Report No. 4: Civil Transport in PLA Power Projection" (2019). CMSI China Maritime Reports. 4. https://digital-commons.usnwc.edu/cmsi-maritime-reports/4, 9.

24. Hong Liang, Lee. 2017. China Merchants, Sinotrans & CSC complete strategic reorganization. April 11. Accessed March 11, 2021. https://www.seatrade-maritime.com/asia/china-merchants-sinotrans-csc-complete-strategic-reorganisation.

25. COSCO Shipping Lines Co. Ltd. 2021. About Us. Accessed February 15, 2021. http://lines.coscoshipping.com/home/About/about/Profile.

26. Ibid.

27. COSCO Shipping Specialized Carriers Co., Ltd. n.d. Vehicle Specifications Pure Car Carrier. Accessed February 20, 2021. http://en.spe.coscoshipping.com/col/col12960/index.html.

28. COSCO Shipping Ports Ltd. 2021. COSCO Businesses. Accessed January 30, 2021. https://ports.coscoshipping.com/en/Businesses/Portfolio/#OverseasTerminals.

29. Ye, Min. 2019. "Xi's bridge builder." Boston University Pardee School of Global Studies. December 6. Accessed March 11, 2021. https://www.bu.edu/pardeeschool/files/2019/12/twPL-2019-12-06-6789.pdf.

30. Landbridge Group. 2020. Landbridge. Accessed February 15, 2021. https://www.landbridgegroup.com.au/our-projects/. 2019.

31. Landbridge Group Co., Ltd. (Landbridge Group). Accessed February 25, 2021. https://www.bnamericas.com/en/company-profile/landbridge-group-co-ltd-landbridge-group.

32. Levesque, Greg, and Mark Stokes. 2016. "Blurred Lines: Military-Civil Fusion and the "Going Out" of China's Defense Industry." Pointe Bello.

December. Accessed March 7, 2021. https://static1.squarespace.com/static/569925bfe0327c837e2e9a94/t/593dad0320099e64e1ca92a5/1497214574912/062017_Pointe+Bello_Military+Civil+Fusion+Report.pdf

33. Ibid, 8.

34. U.S. Department of State. 2020. Military-Civil Fusion and the People's Republic of China. March. Accessed March 7, 2021. https://www.state.gov/wp-content/uploads/2020/05/What-is-MCF-One-Pager.pdf.

35.Ibid.

36. "National Intelligence Law of the People's Republic of China." National People's Congress. June 27. Accessed January 30, 2021. https://cs.brown.edu/courses/csci1800/sources/2017_PRC_NationalIntelligenceLaw.pdf.

37. Conor, "China Maritime Report No. 4: Civil Transport in PLA Power Projection", 4.

38. Ibid.

39. U.S.-China Economic and Security Review Commission. 2020. 2020 Report to Congress. Report, Washington, D.C.: U.S.-China

Economic and Security Review Commission, 401.

40. Conor, "China Maritime Report No. 4: Civil Transport in PLA Power Projection", 7.

41. Ibid, 9.

42. Conor, "China Maritime Report No. 4: Civil Transport in PLA Power Projection", 7.

43. Ibid.

44. Conor, "China Maritime Report No. 4: Civil Transport in PLA Power Projection", 14.

45. Naval Sea Systems Command. 2021. Underway Replenishment Keeps our Ships at Sea. Accessed March 11, 2021.

https://www.navsea.navy.mil/Home/Warfare-Centers/NSWC-Port-Hueneme/What-We-Do/Test-Evaluation/UNREP/.

46. U.S.-China Economic and Security Review Commission, 2020 Report to Congress, 386.

47. Ibid.

48. Alexander, Lewis M. 1992. "The Role of Choke Points in the Ocean Context." GeoJournal 26 (4): 504.

49. Ibid, 505.

50. Ibid, 504.

51. Ibid, 505.

52. Ibid, 506.

53. Ibid, 507.

54. National Oceanic and Atmospheric Administration. n.d. "World Meteorological Organization Voluntary Observing Ships Scheme." Resource Watch. Accessed March 15, 2021. https://resourcewatch.org/

55. Center for Strategic and International Studies. 2020. DF-21 (Dong Feng-21 / CSS-5). January 2. Accessed February 10, 2021. https://missilethreat.csis.org/missile/df-21/.

56. Center for Strategic and International Studies. 2020. "Missile Defense Project, "YJ-18"." Center for Strategic and International Studies.

June 25. Accessed February 15, 2020. https://missilethreat.csis.org/missile/yj-18/.

57. Center for Strategic and International Studies. 2018. Image Confirms Chinese Ground-Launched YJ-12 ASCM. November 8. Accessed February 10, 2021. https://missilethreat.csis.org/image-confirms-chinese-ground-launched-yj-12-ascm/

58. Minnick, Wendell. 2015. S-400 Strengthens China's Hand in the Skies. April 18. Accessed March 21, 2021. https://www.defensenews.com/air/2015/04/18/s-400-strengthens-china-s-hand-in-the-skies/.

59. Center for Strategic and International Studies. 2018. Missile Defense Project, "S-300". July 13. Accessed March 21, 2021. https://missilethreat.csis.org/defsys/s-300/.

60. Dutton, Peter A, Isaac B. Kardon, and Conor M Kennedy. 2020. "China Maritime Report No. 6: Djibouti: China's First Overseas Strategic Strongpoint." U.S. Naval War College Digital Commons. April 1. Accessed March 20, 2021. https://digital-commons.usnwc.edu/cgi/viewcontent.cgi?article=1005&context=cmsi-maritime-reports, 44.

61. Wertheim, Eric. 2020. China's Luyang III/Type 052D Destroyer Is a Potent Adversary. January. Accessed March 20, 2021. https://www.usni.org/magazines/proceedings/2020/january/chinas-luyang-iiitype-052d-destroyer-potent-adversary\

62. Center for Strategic and International Studies. "Missile Defense Project, "YJ-18"."

63. Ibid.

64. Ibid.

65. Page, Jeremy, Gordon Lubold, and Rob Taylor. 2019. "Deal for Naval Outpost in Cambodia Furthers China's Quest for Military Network." The Wall Street Journal, July 22.

66. Asia Maritime Transparency Initiative. 2020. Update: Another U.S.-Built Facility at Ream Bites the Dust. November 9. Accessed March 1, 2021. https://amti.csis.org/changes-underway-at-cambodias-ream-naval-base/.

67. The Bangkok Post. 2020. Cambodian PM Says Naval Base Not Just for China. October 7. Accessed March 15, 2021. https://www.bangkokpost.com/world/1998243/cambodian-pm-says-naval-base-not-just-for-china

68. Kumar, P Prem. 2020. Canceled $10.5bn Malaysia Port Project Plays Down China Role. December 3. Accessed February 15, 2021. https://asia.nikkei.com/Business/Transportation/Canceled-10.5bn-Malaysia-port-project-plays-down-China-role.

69. Jiang, Jason. 2019. Landbridge Eyes Listing of Rizhao terminal. June 26. Accessed March 15, 2021. https://splash247.com/landbridge-eyes-listing-of-rizhao-terminal/.

70. Melaka Gateway and KAJ Development. 2019. Melaka Gateway Port. Accessed February 10, 2021.

https://melakagateway.com/island-3-pme3-pulau-panjang/

71. Kuantan Port Consortium. 2016. Kuantan Port. Accessed March 1, 2021. http://www.kuantanport.com.my/.

72. Moody's Investor Service. 2020. "Moody's Assigns First-Time Baa3 Rating to Guangxi Beibu Gulf International; Outlook Stable." Moody's.

September 29. Accessed March 15, 2021. https://www.moodys.com/research/Moodys-assigns-first-time-Baa3-rating-to-Guangxi-Beibu-Gulf--PR_433610.

73. Infospectrum. 2021. Beibu Gulf Holding (Hong Kong) Co., Limited. Accessed March 15, 2021.

http://portal.infospectrum.net/searchorder/GoogleCompanySearch.aspx?CompanyId=98530.

74. Kuantan Port Consortium. 2016. Kuantan Port. Accessed March 1, 2021. http://www.kuantanport.com.my/.

75. PSA International. 2021. Senior Management Council. Accessed March 20, 2021. https://www.globalpsa.com/smc/.

76. COSCO Shipping and PSA. 2019. "COSCO Shipping Ports Limited Strengthens Partnership in Singapore." PSA. January 3. Accessed March 20, 2021. https://www.globalpsa.com/cosco-shipping-ports-limited-strengthens-partnership-in-singapore/.

77. Johnson, Keith. 2020. "China Leaps into Breach Between Myanmar and West." Foreign Policy. January 29. Accessed January 21, 2021. https://foreignpolicy.com/2020/01/29/china-leaps-between-myanmar-west-india-xi-visit/.

78. Lanteigne, Marc. 2008. "China's Maritime Security and the 'Malacca Dilemma'." Asian Security, April 24: 143-161.

79. CITIC Group (Myanmar) Company Limited. 2018. "About Us." CITIC Group (Myanmar) Company Limited. Accessed March 1, 2021. http://www.citicmyanmar.com/index.php?m=content&c=index&a=lists&catid=19.

80. CITIC Group (Myanmar) Company Limited. 2018. "KPSEZ DSP." CITIC Group (Myanmar) Company Limited. Accessed March 1, 2021. http://www.citicmyanmar.com/index.php?m=content&c=index&a=lists&catid=498.

81. Sri Lanka Ports Authority. 2020. Projects. Accessed February 24, 2021. https://www.slpa.lk/port-colombo/projects. 2021.

82. CHEC Port City Colombo (Pvt) LTD. Accessed March 20, 2021. https://www.portcitycolombo.lk.

83. Aneez, Shihar, and Ranga Sirilal. 2014. Chinese Submarine Docks in Sri Lanka Despite Indian Concerns. November 2. Accessed March 20, 2021. https://www.reuters.com/article/sri-lanka-china-submarine-idINKBN0IM0LU20141102.

84. Aneez, Shihar, and Ranga Sirilal. 2017. Sri Lanka Rejects Chinese Request for Submarine Visit: Sources. May 11. Accessed March 20, 2021. https://www.reuters.com/article/us-sri-lanka-china-submarine-idUSKBN1871P9.

85. 2020. China Merchants Ports Holdings Ltd. Accessed March 3, 2021. http://www.cmport.com.hk/EN/business/.

86. China COSCO Shipping Corporation, Ltd. 2017. COSCO SHIPPING Ports & Abu Dhabi Ports Witnessed Ground-Breaking at Khalifa Port and Signed New CFS Agreement. November 6. Accessed February 1, 2021. http://en.coscoshipping.com/art/2017/11/6/art_6923_67941.html.

87. Rahman, Fareed. 2018. Cosco built container terminal opens in Abu Dhabi. December 10. Accessed February 24, 2021. https://gulfnews.com/business/energy/cosco-built-container-terminal-opens-in-abu-dhabi-1.60856478.

88. Dutton, Peter A, Isaac B. Kardon, and Conor M Kennedy. "China Maritime Report No. 6: Djibouti: China's First Overseas Strategic Strongpoint.", 9.

89. Xinhua. 2018. China Harbour builds new terminal south of Egypt's Suez Canal. August 29. Accessed March 1, 2021. http://www.xinhuanet.com/english/2018-08/29/c_137428464.htm. Port Strategy. 2019.

90. DP World Sokhna Enters Trilateral Partnership. December 09. Accessed March 1, 2021. https://www.portstrategy.com/news101/world/middle-east/dp-world-sokhna-enters-trilateral-partnership.

91. 2015. China Overseas Ports Holding Company Pakistan Ltd. Accessed February 20, 2021. http://cophcgwadar.com/about.aspx.\

92. Quwa Defence News & Analysis Group. 2021. Zulfiquar-Class (F-22P) Frigate. March 25. Accessed March 28, 2021. https://quwa.org/2020/06/06/pakistan-navy-ships-zulfiquar-class-f-22p-frigate/.

93. Xuanzun, Liu. 2021. China launches 2nd Type 054A/P frigate for Pakistan. January 29. Accessed March 1, 2021. https://www.globaltimes.cn/page/202101/1214356.shtml.

94. International Trade Administration. 2020. Algeria's El-Hamdania Port. March 3. Accessed March 1, 2021. https://www.trade.gov/market-intelligence/algerias-el-hamdania-cherchell-project.

95. Ibid.

96. Rogers, David. 2017. Africa's Port Revolution: A Tale of Two Port Cities. April 3. Accessed March 1, 2021. https://www.globalconstructionreview.com/sectors/africas-ports-revolution-tale-t7wo-p7ort-citi7es/.

97. Zoubir, Yahia H. 2020. "Expanding Sino-Maghreb Relations: Morocco and Tunisia." Chatham House. February 26. Accessed

February 6, 2021. https://www.chathamhouse.org/2020/02/expanding-sino-maghreb-relation, 4.

98. Abdel Ghafar, Adel, and Anna L. Jacobs. 2019. "Beijing Calling: Assessing China's Growing Footprint in North Africa." Brookings. September 23. Accessed March 1, 2021. https://www.brookings.edu/research/beijing-calling-assessing-chinas-growing-footprint-in-north-africa/

99. Ibid.

100. 2017. Cosco closes on $42 million Zeebrugge port deal. November 8. Accessed February 15, 2021. https://www.joc.com/port-news/european-ports/port-zeebrugge/cosco-closes-42-million-zeebrugge-port-deal_20171108.html.

101. COSCO Shipping Lines (Belgium) NV. 2018. COSCO SHIPPING Ports Sign Concession Agreement with Port of Zeebrugge. January 22. Accessed March 25, 2021. http://www.coscoshippinglines.be/content/cosco-shipping-ports.

102. Chang, Gordon G. 2020. China in The Mediterranean. January 10. Accessed February 4, 2021. https://www.hoover.org/research/china-mediterranean#:~:text=The%20port%20of%20Piraeus%20is,franchise%20rights%20for%2035%20years.

103. Kastner, Jens, and Giannis Seferiadis. 2020. COSCO Faces Backlash as it Moves to Tighten Grip on Greek Port. December 2. Accessed March 20, 2021. https://asia.nikkei.com/Business/Transportation/COSCO-faces-backlash-as-it-moves-to-tighten-grip-on-Greek-port

104. COSCO Shipping Ports Limited. 2017. "COSCO SHIPPING Ports Limited Acquisition of Interest in Noatum Port Holdings in Spain." Press Releases.

June 12. Accessed March 25, 2021. https://ports.coscoshipping.com/en/Media/PressReleases/content.php?id=20170612.

105. Port Authority of Valencia. 2021. About Us. Accessed March 25, 2021. https://www.valenciaport.com/en/port-authority-valencia/about-valencia-port/about-us/.

106. China Merchants Ports Holding Company Ltd. 2015. "A CMHI-Involved Tripartite Consortium Agreed to Acquire 65% Equity Interests in Kumport Terminal in Turkey." China Merchants Ports Holding Company Ltd. September 17. Accessed March 27, 2021. http://www.cmport.com.hk/enTouch/news/Detail.aspx?id=10001628.

107. 2021. China Investment Corporation - Articles of Association. Accessed March 27, 2021. http://www.china-inv.cn/chinainven/Governance/Articles_of_Association.shtml.

108. Panama Colon Container Port. 2018. Panama Colon Container Port. Accessed February 5, 2021. http://www.pccp.com.pa/

109. Ibid.

Timeline

Nov 01, 2021

Zeebrugge Container Terminal acquired by COSCO

Feb 01, 2021

Panama Colon: Construction Stalls

Mar 18, 2020

Melacca: Project stalls

Approximate dateJan 12, 2020

Kyaukphyu Development deal signed

Jul 22, 2019

Ream Naval Base: Chinese Naval usage agreement signed

Apr 01, 2019